The Rise of Automotive Aluminum Casting: A Technical Review of Lightweighting Trends and Wheel Rim Innovations

This technical summary is based on the academic paper "Application of Aluminum and ITS Alloys in the Automotive Industry With Special Emphasis PN Wheel Rims" by Dragan Adamović, Tomislav Vujinović, Fatima Živić, Jelena Živković, and Marko Topalović, published in TTTP (2021)6(2):87-95.

![Figure 3. Average Al Content per Vehicle by Brand 2019, (Net Weight in Kg) [5]](https://castman.co.kr/wp-content/uploads/image-3464-1024x544.webp)

Keywords

- Primary Keyword: Automotive Aluminum Casting

- Secondary Keywords: lightweighting in automotive, aluminum wheel rims, aluminum alloys for cars, vehicle weight reduction, casting vs forging aluminum

Executive Summary

- The Challenge: Automakers face immense pressure to reduce vehicle weight to improve fuel efficiency and lower emissions, a trend driven by regulations and the shift towards electric vehicles.

- The Method: The paper analyzes comprehensive industry data to quantify the use of aluminum and its alloys in European passenger cars, focusing on trends by component, manufacturing process, and vehicle segment.

- The Key Breakthrough: The average aluminum content per vehicle is steadily increasing (from 180 kg to a projected 200 kg by 2025), with casting remaining the dominant manufacturing process, accounting for approximately 65% of all aluminum components by weight.

- The Bottom Line: Automotive aluminum casting is the cornerstone of modern vehicle lightweighting strategies, particularly for high-volume components like engine parts, chassis components, and wheel rims, which alone constitute nearly 15% of the total aluminum used.

The Challenge: Why This Research Matters for HPDC Professionals

Since the oil crisis of the 1970s, the automotive industry has been on a relentless quest for efficiency. Today, with the added pressure of global warming and stringent emissions standards, reducing vehicle weight is more critical than ever. Every 100 kg reduction in a car's weight can lower CO₂ emissions by 8 grams per kilometer. While steel remains a primary material, its density presents a significant hurdle.

This paper addresses the core challenge: how to effectively and economically reduce vehicle weight to meet modern sustainability and performance demands. For engineers in the casting industry, this isn't just an academic question—it's a direct driver of market demand. The research highlights that aluminum, a lightweight and versatile metal, is the leading solution, creating immense opportunities for advanced casting processes that can deliver complex, high-strength, and lightweight components at scale.

The Approach: Unpacking the Methodology

This study is a comprehensive review and analysis of the current state and future trajectory of aluminum use in the European automotive sector. The authors synthesized data from authoritative industry sources, including the European Aluminium Association and the 2019 Ducker study on aluminum content in passenger cars.

The methodology involved a multi-faceted data analysis:

- Component-Level Analysis: The research breaks down aluminum usage by key vehicle systems, such as the engine, chassis, body structure, and wheels, to identify where the material delivers the most impact.

- Process-Level Analysis: The study quantifies the market share of different manufacturing methods—casting, forging, sheet forming, and extrusion—to reveal which technologies are most critical to the industry.

- Trend Projection: By analyzing historical data and market drivers (like the growth of electric vehicles), the paper projects the evolution of aluminum content and processing methods through 2025.

This approach provides a robust, data-driven overview that is invaluable for strategic planning in the automotive supply chain.

The Breakthrough: Key Findings & Data

The paper presents several critical findings that underscore the strategic importance of aluminum and, specifically, automotive aluminum casting.

Finding 1: Aluminum Content is Growing Significantly

The average aluminum content in European passenger cars is substantial and on the rise. In 2019, the average vehicle contained 179.2 kg of aluminum. This figure is projected to increase by nearly 20 kg to 198.8 kg by 2025. As shown in Figure 8, this growth is primarily driven by new applications in electric vehicles, such as battery boxes (adding 12.38 kg) and electric motor housings (adding 2.69 kg), which are often complex cast components.

Finding 2: Casting is the Dominant Manufacturing Process

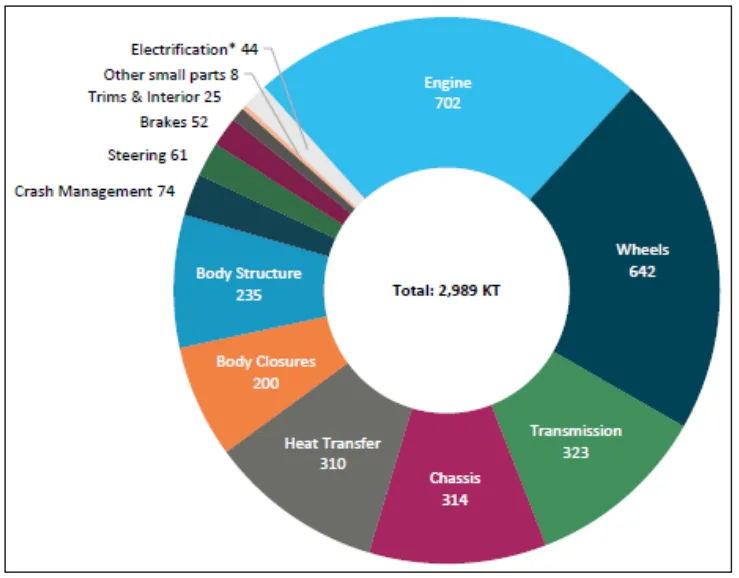

While other manufacturing methods are growing, casting remains the undisputed leader for producing aluminum automotive parts. As detailed in Figure 11, casting accounted for 65% of the total aluminum content (by net weight) in 2019. Engine and wheel components, which are predominantly cast, represent nearly 45% of all aluminum in a typical vehicle (Figure 6). This dominance highlights the maturity, cost-effectiveness, and design flexibility of casting processes for high-volume automotive production.

Practical Implications for R&D and Operations

- For Process Engineers: This study confirms that the demand for high-integrity cast aluminum components is growing, especially for EV applications like motor housings and battery enclosures. This suggests a need to focus on process optimization for complex geometries and alloys that offer superior thermal and structural performance.

- For Quality Control Teams: The data in Table 1, which compares different wheel manufacturing technologies, highlights the critical balance between cost and performance. For cast wheels, ensuring a uniform microstructure to maximize mechanical properties, as mentioned in the low-pressure casting description, is paramount for meeting safety and durability standards.

- For Design Engineers: The findings in Figure 9, comparing the specific strength of aluminum alloys to advanced steels, demonstrate that aluminum is a competitive structural material. This encourages designers to consider cast aluminum not just for traditional powertrain parts but also for body structure and chassis components where energy absorption and stiffness are critical.

Paper Details

Application of Aluminum and ITS Alloys in the Automotive Industry With Special Emphasis PN Wheel Rims

1. Overview:

- Title: Application of Aluminum and ITS Alloys in the Automotive Industry With Special Emphasis PN Wheel Rims

- Author: Dragan Adamović, Tomislav Vujinović, Fatima Živić, Jelena Živković, Marko Topalović

- Year of publication: 2021

- Journal/academic society of publication: TTTP (Journal of Trends and Technology in Processing and Preservation)

- Keywords: Aluminum alloys, light metals, steels, automotive industry, wheel rims

2. Abstract:

The use of aluminum in modern cars began in the early 1970s, when under the pressure of the oil crisis, car manufacturers around the world began to reduce the weight of cars in order to achieve the lowest possible fuel consumption. The first applications of larger volumes were radiators, engine blocks and wheels. Meanwhile, in Europe, the average amount of consumed aluminum has continued to increase, reaching an average of 180 kg per car. Aluminum castings, forgings, sheets and extruded parts are used for a large number of car parts, including car bodies, chassis, suspensions, wheels and many others. The use of aluminum is also important for hybrid and battery electric cars. Due to the threat of global warming due to the greenhouse effect, it is very important to reduce the weight of the car by using aluminum, and thus fuel consumption. This paper explains why, now more than ever, vehicle weight reduction is necessary and how aluminum can be used to further improve the sustainability and safety of future generations of cars. Special attention is given to the use of aluminum for car wheels, which represent almost 15% of the average aluminum content in passenger cars.

3. Introduction:

Metals are the most commonly used materials in the automotive industry, with steel and aluminum being the most important. The use of aluminum is becoming more frequent due to its lightweight properties, which contribute to weight savings and potentially lower production costs through new processing technologies. The paper notes the historical example of the "Audi A2" as a famous aluminum car whose high production cost, stemming from the expense of aluminum manufacturing technology compared to steel, limited its commercial success. The introduction establishes that lightweight materials like aluminum alloys offer significant benefits beyond just weight savings, including improved vehicle properties and energy efficiency.

4. Summary of the study:

Background of the research topic:

The study is set against the backdrop of the automotive industry's continuous need for vehicle weight reduction. This need is driven by historical factors like the 1970s oil crisis and contemporary pressures such as climate change, the greenhouse effect, and the resulting demand for lower fuel consumption and emissions. The paper positions aluminum as a key material for achieving these lightweighting goals.

Status of previous research:

The paper builds upon established industry data and trends. It references studies and reports (e.g., Ducker study 2019) that have quantified the amount of aluminum in vehicles. It acknowledges that aluminum provides weight savings of up to 50% compared to competing materials in many applications. The paper also discusses the state of different aluminum processing technologies (casting, forging, extrusion, sheet forming) and material comparisons (aluminum vs. steel, magnesium, composites) for specific components like wheel rims.

Purpose of the study:

The purpose is to provide a comprehensive overview of the application of aluminum and its alloys in the modern automotive industry. It aims to explain why vehicle weight reduction is critical and how aluminum is used to improve the sustainability and safety of cars. A special emphasis is placed on the use of aluminum for wheel rims, a significant contributor to the total aluminum content in a vehicle.

Core study:

The core of the study involves analyzing and presenting data on aluminum usage in European passenger cars. It examines the average aluminum content per vehicle and its projected growth. The study breaks down this usage by vehicle segment (e.g., C-compact), by component group (engine, wheels, chassis, etc.), and by manufacturing process (casting, forging, etc.). It highlights that engine and wheel components account for ~45% of the total aluminum share. The paper further explores the impact of vehicle electrification on aluminum usage, noting a future increase in demand for battery boxes and motor housings. A detailed section is dedicated to wheel rims, comparing various materials (steel, aluminum, magnesium, titanium, composites) and manufacturing technologies (casting, forging) in terms of weight, cost, and performance.

5. Research Methodology

Research Design:

The research is designed as a review paper. It does not conduct new experiments but instead synthesizes and analyzes existing data, literature, and industry reports to present a comprehensive overview of the topic.

Data Collection and Analysis Methods:

Data was collected from published sources, including industry association reports (European Aluminium Association) and specialized studies (Ducker study 2019). The analysis involves quantitative comparisons of aluminum content across different categories (vehicle brands, segments, components, processes) and qualitative comparisons of materials and technologies for applications like wheel rims. The findings are presented through charts, graphs, and tables.

Research Topics and Scope:

The scope is focused on the application of aluminum and its alloys in the European passenger car industry. Key research topics include:

- The overall trend of aluminum consumption in vehicles.

- The distribution of aluminum across different car components.

- The market share of various aluminum processing methods.

- The impact of vehicle electrification on aluminum usage trends.

- A detailed analysis of aluminum wheel rims, including materials, production technologies, and performance comparisons.

6. Key Results:

Key Results:

- The average aluminum content per European car was 179.2 kg in 2019 and is projected to reach 198.8 kg by 2025.

- C-compact segment vehicles account for the largest share (36%) of total aluminum consumption due to their high production volume.

- Engine (702 KT) and wheels (642 KT) are the two largest component groups for aluminum usage, together representing nearly 45% of the total.

- Casting is the most common processing method, accounting for 65% of the total aluminum content in 2019, followed by sheet (19%), extrusions (11%), and forged parts (6%).

- The transition to electric vehicles is expected to increase aluminum use in battery boxes (+12.38 kg/vehicle) and motor housings (+2.69 kg/vehicle) while reducing it in traditional engines (-2.43 kg/vehicle) by 2025.

- For wheel rims, cast aluminum offers a significant weight reduction (15-25%) compared to steel at a moderate cost increase, making it the most common lightweight option. Forged aluminum wheels offer even greater weight savings (20-40%) but at a much higher cost.

Figure Name List:

- Figure 1. Aluminum in the automotive industry, model Audi A2

- Figure 2. Aluminium's direct weight savings [4]

- Figure 3. Average Al Content per Vehicle by Brand 2019, (Net Weight in Kg) [5]

- Figure 4. Car production by segment (2019) [5]

- Figure 5. a) Total AL Content by Vehicle Segment (2019, Net Weight in %), b) Average AL Content by Vehicle Segment (2019, Net Weight in kg) [5]

- Figure 6. Total Aluminum Content by Component Group 2019, Net Weight in KT [5]

- Figure 7. Average Aluminum Content per Vehicle by Component Group Incl. all powertrain types, (Net Weight in kg) (2019 year) [5]

- Figure 8. Expected AL Gains & Losses within Average AL Content per Vehicle For the time period 2019 to 2025 (Net Weight in kg) [5]

- Figure 9. Weight specific comparison of the mechanical properties of aluminium and steels [8]

- Figure 10. The average presence of aluminum in cars according to the processing method [5]

- Figure 11. Forming Process Split of Total AL Content (Net Weight in KT) [5]

- Figure 12. Car wheels made of different materials

- Figure 13. Aluminium foam wheel

- Figure 14. Wheels made by the process of a) casting and b) forging

- Figure 15. Aluminum wheels made as a) one-piece (monoblock), b) two-piece and c) three-piece

![Figure 5. a) Total AL Content by Vehicle Segment (2019, Net Weight in %), b) Average AL Content by Vehicle Segment (2019, Net Weight in kg) [5]](https://castman.co.kr/wp-content/uploads/image-3465-1024x347.webp)

![Figure 8. Expected AL Gains & Losses within Average AL Content per Vehicle For the time period 2019 to 2025 (Net

Weight in kg) [5]](https://castman.co.kr/wp-content/uploads/image-3467-1024x540.webp)

7. Conclusion:

The average weight of passenger cars has increased since the 1970s, making lightweighting more crucial than ever for reducing CO₂ emissions. Aluminum is an ideal material for this purpose, offering weight savings of up to 50% compared to competing materials without compromising safety. Modern European cars contain an average of 180 kg of aluminum, with a trend to increase to 200 kg by 2025. This can be achieved without major reengineering, potentially reducing average car weight by 40 kg. While the cost of aluminum is a challenge, reducing its cost and using modern processing technologies will increase its application in the automotive industry.

8. References:

- [1] J. Hirsch, Automotive Trends in Aluminium - The European Perspective, Proceedings of the 9th International Conference on Aluminium Alloys, 2-5 August 2004 Brisbane, Australia, p.p. 15-23 J.

- [2] Akiyoshi Morita, Aluminum Alloys For Automobile Applications, Proceedings of the 6th International Conference on Aluminium Alloys, July 5-10 1998, Toyohashi, Japan, p.p. 25-32

- [3] [Hideo Yoshida, Alloy Development for Transportation in Sumitomo Light Metal, Proceedings of the 12th International Conference on Aluminium Alloys, September 5-9, 2010, Yokohama, Japan]

- [4] Aluminium in cars, EAA brochure, European aluminium association, Brussel, 2007-Internet: www. alucars.org

- [5] Aluminum Content In European Passenger Cars, (Ducker study public summary 2019) https://www.european-aluminium.eu/media/2802/aluminum-content-in-european-cars_european-aluminium_public-summary_101019-1.pdf

- [6] North America Light Vehicle Aluminum Content And Outlook, DUCKERFRONTIER, Final Report Summary: July 2020, Prepared for The Alluminum Association, Presentation, https://www.drivealuminum.org/

- [7] Mahmoud Y. Demeri, Advanced High-Strength Steels Science, Technology, and Applications, ASM International, Materials Park, Ohio 2013, ISBN-10: 1-62708-005-8

- [8] The Aluminium Automotive Manual, Design - Design with Aluminium, Version 2011 European Aluminium Association, https://www.european-aluminium.eu/resource-hub/aluminium-automotive-manual/

- [9] Juugen Hirsch, Aluminium in Innovative Light-Weight Car Design, Materials Transactions, Vol. 52, No. 5 (2011) pp. 818 to 824, Special Issue on Aluminium Alloys 2010, The Japan Institute of Light Metals

- [10] Chintala Sai Virinchy, Abdul Hafeezasif, V. Jayakumar, D. Santhosh Kumar, Marrireddy Raviteja Reddy, A Review On Selection, Manufacturing And Testing Of Composite Materials For Alloy Wheels, International Journal of Pure and Applied Mathematics, Volume 118 No. 9 2018, 331-343, ISSN: 1311-8080 (printed version); ISSN: 1314-3395 (on-line version), url: http://www.ijpam.eu, Special Issue

- [11] A Naim, R Kumar and S Bhatia, A review paper on materials used for manufacturing of alloy wheels, IOP Conf. Series: Materials Science and Engineering 1136 (2021) 012006, doi:10.1088/1757-899X/1136/1/012006

- [12] Paritud Bhandhubanyong and John T. H. Pearce, Materials on Wheels: Moving to Lighter Auto-bodies, International Scientific Journal Of Engineering And Technology (ISJET), Vol. 2 No. 1 pp 27-36, January-June 2018

- [13] D.Sameer Kumar, K.N.S.Suman, Selection of Magnesium Alloy by MADM Methods for Automobile Wheels, I.J. Engineering and Manufacturing, 2014, 2, 31-41 Published Online August 2014 in MECS (https://www.mecs-press.org/) DOI: 10.5815/ijem.2014.02.03

- [14] K. Srinivasa Rao, M. Rajesh, G. Sreedhara Babu, DESIGN AND ANALYSIS OF ALLOY WHEELS, International Research Journal of Engineering and Technology (IRJET), Volume: 04 Issue: 06 | June -2017, p.p. 2036-2042, e-ISSN: 2395-0056

- [15] T. Siva Prasad, T. Krishnaiah, J. Md. Iliyas, M.Jayapal Reddy, A Review on Modeling and Analysis of Car Wheel Rim using CATIA & ANSYS, International Journal of Innovative Science and Modern Engineering (IJISME), ISSN: 2319-6386, Volume-2, Issue-6, May 2014

- [16] The Aluminium Automotive Manual, Applications - Chassis & Suspension - Wheels, Version 2011 European Aluminium Association, https://www.european-aluminium.eu/resource-hub/aluminium-automotive-manual/

- [17] Aluminium Alloy Wheels Manufacturing Process, Materials and Designhttps: https://matmatch.com/resources/blog/aluminium-car-wheels/

- [18] Aluminum Foam Technology Applied To Automotive Design, Cymat Technologies Ltd., https://www.cymat.com/

- [19] The Aluminium Automotive Manual, Materials - Special materials production, Version 2011 European Aluminium Association, https://www.european-aluminium.eu/resource-hub/aluminium-automotive-manual/

- [20] Jun Ou, Chunying Wei, Steve Cockcroft, Daan Maijer, Lin Zhu, Lateng A, Changhai Li and Zhihua Zhu, Advanced Process Simulation of Low Pressure Die Cast A356 Aluminum Automotive Wheels- Part I, Process Characterization, Metals 2020, 10, 563; doi:10.3390/met10050563, https://www.mdpi.com/journal/metals

Expert Q&A: Your Top Questions Answered

Q1: Why does the paper place such a strong emphasis on aluminum wheel rims?

A1: The paper focuses on wheel rims because they are one of the single largest applications of aluminum in a passenger car. According to the abstract, wheels represent almost 15% of the average aluminum content. As shown in Figure 6, "Wheels" are the second-largest component group by weight (642 KT) after the "Engine" (702 KT). This makes them a critical area for lightweighting and a major market for aluminum producers and casters.

Q2: According to the paper, what are the primary trade-offs when choosing between cast and forged aluminum wheels?

A2: The main trade-offs are cost versus performance and weight. Table 1 shows that cast aluminum wheels are significantly cheaper (relative cost of 4.5) than forged aluminum wheels (relative cost of 10.0). However, forged wheels offer a greater potential for weight reduction (down to 60% of a steel wheel's weight) and, as the text states, provide "ultimate strength" and outperform cast wheels in impact and fatigue performance.

Q3: How is the industry trend toward electric vehicles (EVs) expected to change the use of aluminum?

A3: The shift to EVs will cause a significant redistribution of aluminum within the vehicle. Figure 8 clearly illustrates this trend. The use of aluminum in traditional components like engines (-2.43 kg) and transmissions (-0.58 kg) will decrease. Conversely, there will be a substantial increase in aluminum for new EV-specific components, primarily battery boxes (+12.38 kg) and electric motor housings (+2.69 kg).

Q4: The paper states that casting is the dominant process. Is its dominance expected to shrink in the future?

A4: Figure 11 suggests a slight shift in the process mix by 2025. The percentage share of casting is projected to decrease from 65% in 2019 to 59% in 2025. However, because the total aluminum content per car is increasing, the absolute volume of cast parts will likely remain very high. The shares for sheet metal (19% to 22%) and extrusions (11% to 13%) are projected to grow, driven by applications in body structures and battery enclosures.

Q5: What specific aluminum alloys are mentioned as being important for automotive wheels?

A5: The paper highlights that Al-Si type alloys are the most common for cast wheels. Specifically, it mentions that the heat-treated AlSi7Mg0.3 alloy is widely used in Europe and Japan. For non-heat-treated wheels, which are mainly made in Germany, the AlSi11Mg alloy is preferred due to its favorable casting ability and shrinkage properties. For forged wheels, the paper identifies EN AV-AlSi1MgMn (6082) in Europe and AA-6061 (AlSiMgCu) in the USA as the most commonly used alloys.

Q6: Besides wheels, what other automotive parts are highlighted as key applications for aluminum?

A6: The paper mentions a wide range of applications. The abstract and Figure 2 list radiators, engine blocks, car bodies, chassis, and suspensions as major uses. Figure 6 provides a comprehensive breakdown, showing significant aluminum content in the engine, transmission, chassis, heat transfer systems, body structure, and body closures (like hoods and trunk hatches).

Conclusion: Paving the Way for Higher Quality and Productivity

The imperative to reduce vehicle weight for improved efficiency and lower emissions is reshaping the automotive materials landscape. This comprehensive review solidifies the central role of aluminum in this transformation. The key takeaway is clear: Automotive Aluminum Casting is not just a legacy process but a critical technology for the future, essential for producing the complex, lightweight components needed for both conventional and electric vehicles.

The data-driven insights from this paper provide a roadmap for the industry. The growing demand for cast aluminum in everything from wheel rims to sophisticated EV battery housings presents a clear opportunity. At CASTMAN, we are committed to applying the latest industry research to help our customers achieve higher productivity and quality. If the challenges discussed in this paper align with your operational goals, contact our engineering team to explore how these principles can be implemented in your components.

Copyright Information

This content is a summary and analysis based on the paper "Application of Aluminum and ITS Alloys in the Automotive Industry With Special Emphasis PN Wheel Rims" by "Dragan Adamović, Tomislav Vujinović, Fatima Živić, Jelena Živković, and Marko Topalović".

Source: https://doi.org/10.7251/JTTTP2102087A

This material is for informational purposes only. Unauthorized commercial use is prohibited.

Copyright © 2025 CASTMAN. All rights reserved.