A Strategic Comparison of the Slovak and Czech Foundry Industries: Key Trends for HPDC Suppliers

This technical summary is based on the academic paper "COMPARISON OF FOUNDRY INDUSTRY IN SLOVAKIA AND CZECH REPUBLIC" by Roland ŠUBA¹, Ingrida BAJČIČÁKOVÁ¹, Martin BAJČIČÁK¹, Štefan PODHORSKݹ, Antonín KŘÍŽ², published in RESEARCH PAPERS FACULTY OF MATERIALS SCIENCE AND TECHNOLOGY IN TRNAVA (2020).

Keywords

- Primary Keyword: Foundry Industry Comparison

- Secondary Keywords: HPDC, Slovakia foundry industry, Czech Republic foundry industry, automotive casting, casting techniques, ferrous metals, non-ferrous metals

Executive Summary

- The Challenge: To understand the structural differences, production capacities, and market dynamics of the foundry industries in Slovakia and the Czech Republic, two key players in the European automotive supply chain.

- The Method: The study compiled and analyzed public data from 38 foundries in Slovakia and 66 foundries in the Czech Republic, focusing on revenues, casting techniques, materials, and employee structures.

- The Key Breakthrough: The research reveals significant structural differences, with the Czech foundry industry being larger in scale and revenue, while Slovakia shows a higher concentration of foundries utilizing high pressure die casting (HPDC).

- The Bottom Line: Both nations' foundry industries are heavily dependent on the automotive sector, and understanding their unique production capabilities and specializations is critical for strategic sourcing, risk management, and market analysis.

The Challenge: Why This Research Matters for HPDC Professionals

For any company involved in the European automotive or industrial sectors, Central Europe is a critical hub for manufacturing and sourcing. After the split of Czechoslovakia in 1993, Slovakia and the Czech Republic developed distinct industrial landscapes. For procurement specialists, R&D managers, and strategic planners in the die casting industry, a lack of clear, comparative data makes it difficult to assess the capabilities, specializations, and scale of these two important markets. Understanding this landscape is essential for identifying the right partners, mitigating supply chain risks, and recognizing market trends, such as the increasing demand for lightweight non-ferrous components.

The Approach: Unpacking the Methodology

The researchers conducted a comprehensive comparative analysis by collecting and synthesizing data from a wide range of public sources. This approach provides a robust snapshot of the two industries.

Method 1: Data Compilation and Synthesis: Information regarding production tonnage, revenues, and company specifics was gathered from industry reports (caef.eu), financial databases (finstat.sk), and public registries (justice.cz). The study analyzed data for approximately 38 foundries in Slovakia and 66 in the Czech Republic.

Method 2: Technical Capability Mapping: The researchers compiled information directly from foundry websites to map the specific casting techniques (e.g., HPDC, LPDC, gravity casting), materials used (e.g., Al alloys, cast irons, steels), and moulding technologies employed in each country. This allowed for a direct, percentage-based comparison of technical capabilities across the two markets.

The Breakthrough: Key Findings & Data

The comparison revealed distinct profiles for the Slovak and Czech foundry industries, offering valuable insights for strategic decision-making.

Finding 1: The Czech Republic Leads in Scale and Revenue

The Czech foundry industry is significantly larger in both total output and average company size. In 2019, the total revenue of the surveyed Czech foundries was nearly double that of their Slovak counterparts. The average revenues of foundries in the Czech Republic are almost two times higher than in Slovakia. This suggests a market with larger, more established players.

Finding 2: Slovakia Shows Higher Specialization in High Pressure Die Casting (HPDC)

While the Czech Republic has a higher percentage of foundries using gravity casting (88% vs. 63%), Slovakia's industry shows a greater concentration in advanced die casting methods. As shown in Figure 5, 42% of Slovak foundries utilize HPDC, compared to only 18% in the Czech Republic. This indicates a stronger specialization in producing complex, lightweight non-ferrous components, likely driven by the automotive sector's demands.

Finding 3: Different Material Focus and End-Market Structure

The two countries exhibit different specializations in materials. The Czech Republic has a much higher percentage of foundries working with steels (32% vs. 21% in Slovakia) and cast irons (56% vs. 26% in Slovakia), as seen in Figure 6. This points to a broader industrial base beyond automotive. In contrast, both countries show a strong focus on aluminum alloys, with 61% of Slovak and 55% of Czech foundries casting these materials, underscoring the automotive industry's influence across the region.

Practical Implications for R&D and Operations

- For Process Engineers: This study suggests that when seeking suppliers for HPDC components, Slovakia may offer a higher concentration of specialized foundries. The data in Figure 5 highlights this clear difference in technological focus.

- For Quality Control Teams: The data in Figure 6 illustrates the different material specializations. Procurement and quality teams sourcing steel or cast iron components will find a larger supplier base in the Czech Republic, while the base for aluminum alloys is strong in both nations.

- For Design Engineers: The findings indicate that the prevalence of HPDC in Slovakia could mean greater regional expertise in designing for complex, thin-walled aluminum castings. This is a crucial consideration for lightweighting initiatives in the automotive sector.

Paper Details

COMPARISON OF FOUNDRY INDUSTRY IN SLOVAKIA AND CZECH REPUBLIC

1. Overview:

- Title: COMPARISON OF FOUNDRY INDUSTRY IN SLOVAKIA AND CZECH REPUBLIC

- Author: Roland ŠUBA, Ingrida BAJČIČÁKOVÁ, Martin BAJČIČÁK, Štefan PODHORSKÝ, Antonín KŘÍŽ

- Year of publication: 2020

- Journal/academic society of publication: RESEARCH PAPERS FACULTY OF MATERIALS SCIENCE AND TECHNOLOGY IN TRNAVA, SLOVAK UNIVERSITY OF TECHNOLOGY IN BRATISLAVA

- Keywords: Foundry, casting, ferrous metals, non-ferrous metals

2. Abstract:

Foundry industry is an important supplier of complex shape parts for other industrial branches. It depends on the development of customer demand in other industries. The current paper compares the structure and sales of foundry industry in Slovakia and Czech Republic.

3. Introduction:

Metal castings are utilized in a vast array of applications, including automotive parts, infrastructure, power generation, and industrial equipment. The growth of the automotive industry and the need for infrastructure are key drivers for the foundry products market. This market can be segmented by product (e.g., grey iron, ductile iron, non-ferrous), industry size (micro to medium), and end-use application (e.g., automotive, sanitary, power industry). The automotive segment holds the major market share. The European foundry industry contributes approximately 20% of the worldwide castings tonnage. The former Czechoslovakia had significant production capacities, and following its division in 1993, the independent nations of Slovakia and the Czech Republic developed their own foundry industries. This paper aims to compare the structure and sales of these two industries to identify their similarities and differences.

4. Summary of the study:

Background of the research topic:

The foundry industry serves as a critical supplier to major industrial sectors, particularly the automotive industry. The European foundry sector is a significant global producer. Following the 1993 separation of Czechoslovakia, the foundry industries in the newly formed Slovakia and Czech Republic evolved independently, creating a need for a comparative analysis of their current structures and capacities.

Status of previous research:

The paper references existing data on the European and global foundry markets from sources such as Transparency Market Research [1], CAEF (The European Foundry Association) [2, 4], and Modern Casting [5]. It also draws on a 2016 conference paper on the development of the Slovak foundry industry [3]. This study builds upon this existing data by performing a direct, multi-faceted comparison between the Slovak and Czech industries.

Purpose of the study:

The primary purpose is to compare the structure and sales of the foundry industry in Slovakia and the Czech Republic. The paper seeks to reveal the similarities and differences between the two industries in terms of revenue, production technologies, materials cast, and company size.

Core study:

The study conducts a comparative analysis of the foundry industries in Slovakia (approx. 38 foundries) and the Czech Republic (approx. 66 foundries). The comparison is based on quantitative data compiled from public sources for the period 2015-2019. Key areas of comparison include the percentage distribution of revenues, total and average revenues, casting techniques used (e.g., gravity casting, HPDC, LPDC), types of metals and alloys cast, types of moulds and dies used, moulding techniques, and the distribution of foundries by employee numbers.

5. Research Methodology

Research Design:

The study employs a quantitative, comparative research design. It analyzes and contrasts statistical data and technical information from foundries in two different countries over a five-year period (2015-2019) to identify structural patterns, differences, and similarities.

Data Collection and Analysis Methods:

Data was compiled from publicly available sources. Information on moulds, casting techniques, and metals cast was gathered from the websites of individual foundries. Revenue data was compiled from financial information websites and public registries in Slovakia [6] and the Czech Republic [7]. Industry-level statistics on production tonnage were sourced from industry associations [2, 3, 4, 5]. The collected data was then analyzed to calculate percentage distributions and create comparative charts.

Research Topics and Scope:

The research scope is limited to the foundry industries in Slovakia and the Czech Republic. The study covers approximately 38 foundries in Slovakia and 66 in the Czech Republic. The topics investigated include:

- Revenues (total, average, and distribution by revenue bracket)

- Casting techniques (gravity, LPDC, HPDC, centrifugal, squeeze, rheocasting)

- Cast metals and alloys (Al, Cu, steels, cast irons, Zn, Mg)

- Mould and die usage (metal die, sand mould, silicone mould, ceramic mould)

- Moulding methods (hand ramming, machine moulding, automatic lines)

- Number of employees (distribution by company size)

6. Key Results:

Key Results:

- The Czech Republic's foundry industry is larger in scale, with total revenues in 2019 nearly double those of Slovakia and average foundry revenues almost two times higher.

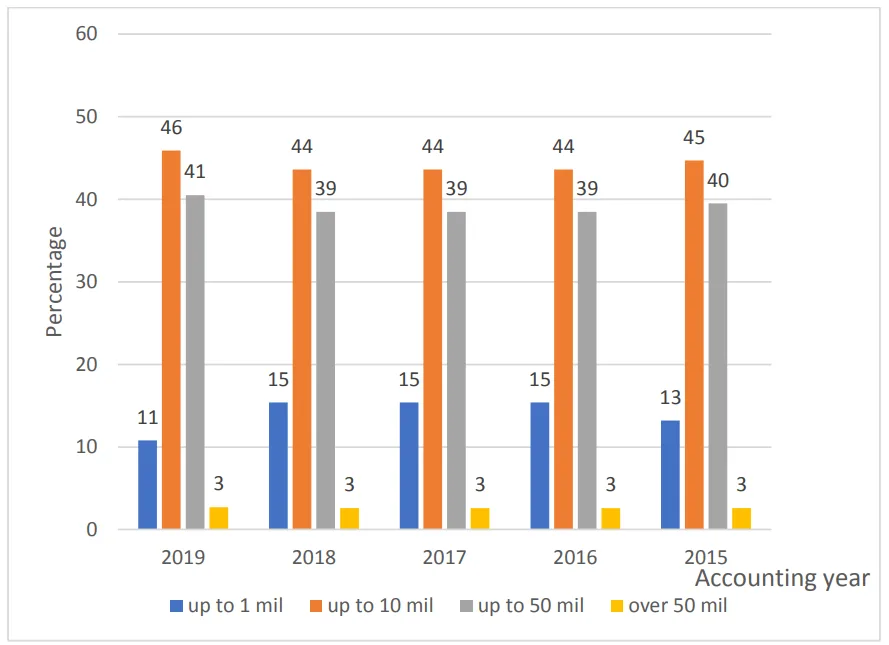

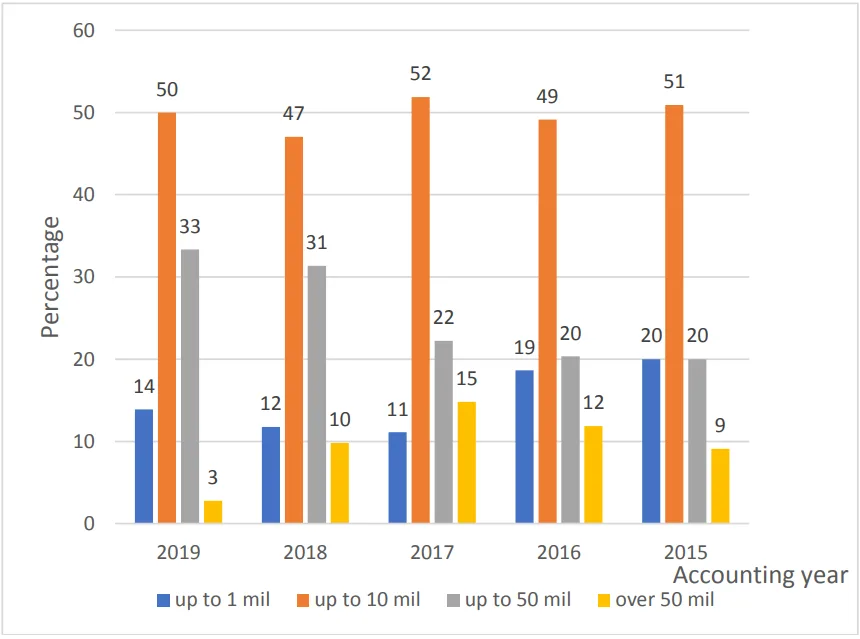

- In Slovakia, the highest percentage of foundries have revenues between 1 to 10 million Eur. In the Czech Republic, the percentage of foundries with revenues over 50 million Eur is almost three times higher than in Slovakia.

- A significantly higher percentage of foundries in Slovakia use high pressure die casting (HPDC) (42%) compared to the Czech Republic (18%). Conversely, a higher percentage of Czech foundries use gravity casting (88%) compared to Slovakia (63%).

- The Czech foundry industry has a higher concentration of foundries producing steel and cast iron castings. Both countries have a high percentage of foundries casting aluminum alloys.

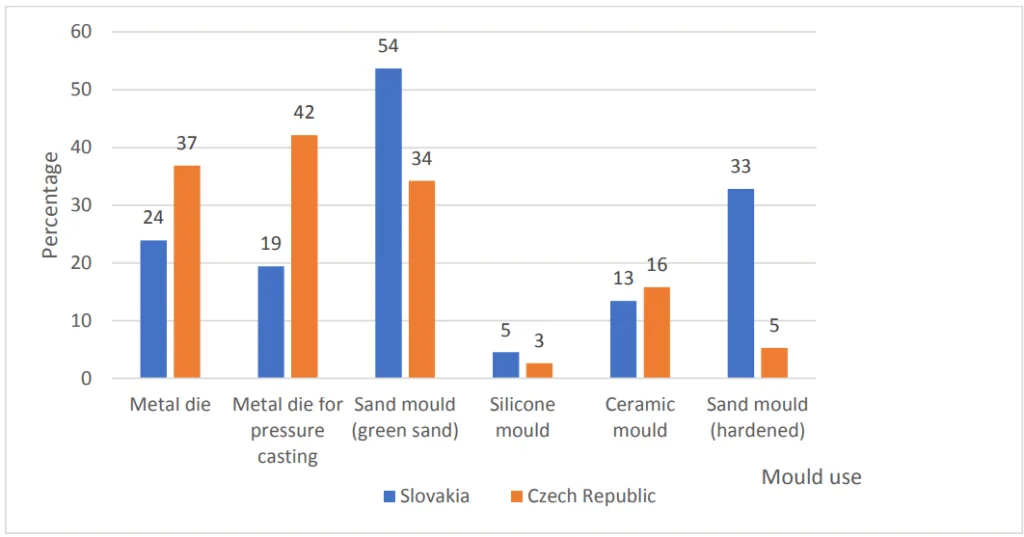

- Foundries in Slovakia use sand moulds (green or hardened) on a much larger scale, while foundries in the Czech Republic use metal dies on a much larger scale.

- The distribution of moulding techniques (hand ramming, machine moulding) is quite similar between the two countries.

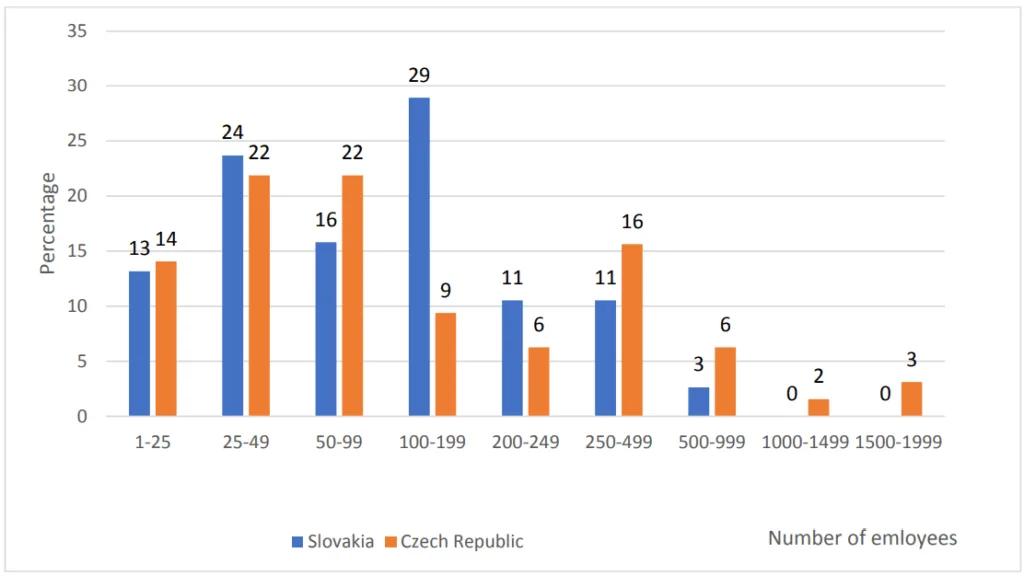

- In terms of employment, the largest share of Czech foundries employ up to 99 people, while in Slovakia, the largest share employs up to 199 people. 4.7% of Czech foundries have more than 999 employees, whereas none in Slovakia do.

Figure Name List:

- Figure 1 Percentage distribution of revenues of foundries in Slovakia

- Figure 2 Percentage distribution of revenues of foundries in Czech Republic

- Figure 3 Comparison of total revenues of foundries in Slovakia and Czech Republic

- Figure 4 Comparison of average revenues of foundries in Slovakia and Czech Republic

- Figure 5 Percentage distribution of casting techniques used in foundries in Slovakia and Czech Republic

- Figure 6 Percentage distribution of foundries in Slovakia and Czech Republic casting various metals and alloys

- Figure 7 Percentage distribution of foundries in Slovakia and Czech Republic using various moulds and dies

- Figure 8 Percentage distribution of foundries in Slovakia and Czech Republic using various methods of moulding

- Figure 9 Percentage distribution of foundries in Slovakia and Czech Republic according to number of employees

7. Conclusion:

The foundry industries in Slovakia and the Czech Republic exhibit both similarities and differences. Both are strongly interconnected with the automotive industry, their largest customer, and are heavily export-oriented. The total tonnage of castings decreased in 2019 compared to 2018, potentially linked to increasing demand for lightweight components and non-metallic materials. The authors predict that the COVID-19 pandemic and its economic fallout will negatively impact the industry in 2020 and 2021, with a recovery to pre-crisis production levels taking several years.

8. References:

- [1] www.transparencymarketresearch.com, Foundry Products Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2017 - 2025 [Online]. [Accessed: 09-2020] Available at https://www.transparencymarketresearch.com/foundry-products-market.html.

- [2] www.caef.eu, The European Foundry Industry at a Glance [Online]. [Accessed: 09-2020] Available at https://www.caef.eu/statistics/.

- [3] VASKOVÁ, I., CIBUĽA, J., CONEV, M. 2016. Development of Slovak Foundry Industry in 21. Century. In: 15th International Foundrymen Conference. Innovation - The Foundation of of Competitive Casting Production. Croatia, Sisak, pp. 55-62. ISBN 978-953-7082-22-2

- [4] www.caef.eu, Statistics, [Online]. [Accessed: 09-2020] Available at https://www.caef.eu/downloads-links/#statistics

- [5] MODERN CASTING STAFF, 2016. 50th Census of World Casting Production. Global Casting Production Stagnant. Modern Casting, pp. 55-62. ISSN: 0026-7562

- [6] finstat.sk: Firmy s finančnými údajmi - databáza hospodárskych výsledkov slovenských firiem. (Financial information on Slovak companies.) [Online]. [Accessed: 09-2020] Available at https://finstat.sk/databaza-financnych-udajov

- [7] www.justice.cz, Veřejný rejstřík. (Public register.) [Online]. [Accessed: 09-2020] Available at https://portal.justice.cz/Justice2/Uvod/uvod.aspx

Expert Q&A: Your Top Questions Answered

Q1: What is the primary reason for the significant difference in the use of High Pressure Die Casting (HPDC) between Slovakia and the Czech Republic?

A1: The paper does not state a direct cause, but it provides data showing a clear difference in technological focus. 42% of Slovak foundries use HPDC versus only 18% in the Czech Republic. The paper notes that the automotive segment accounts for the major share of the foundry market and that both countries are heavily interconnected with this industry. This suggests Slovakia's foundry sector may be more specialized to meet the automotive industry's demand for complex, lightweight non-ferrous parts typically produced via HPDC.

Q2: How does the scale of foundries, measured by employee numbers, differ between the two countries?

A2: The data in Figure 9 shows a notable difference in scale. In the Czech Republic, the largest group of foundries (29%) is in the 100-199 employee range, and a significant 4.7% (combined) employ over 1000 people. In Slovakia, no foundries in the study employed more than 999 people, and the distribution is more evenly spread across the smaller categories, with the largest groups being 25-49 and 50-99 employees. This confirms that the Czech industry contains larger-scale operations.

Q3: The paper mentions a decrease in casting tonnage in 2019. What reasons does it suggest for this?

A3: The conclusion suggests this decrease can be interconnected with two key trends: the increasing demand for lightweight components and the increasing use of non-metallic materials. Both trends directly impact the total tonnage of traditional metal castings produced, particularly for the automotive industry which is a primary customer for both nations' foundries.

Q4: Based on the study, which country offers a broader supplier base for ferrous metal castings like steel and cast iron?

A4: The Czech Republic offers a significantly broader supplier base for ferrous metals. According to Figure 6, 56% of Czech foundries produce cast iron parts compared to only 26% in Slovakia. Similarly, 32% of Czech foundries work with steels, versus 21% in Slovakia. This indicates a much deeper and more diverse industrial capacity for ferrous castings in the Czech Republic.

Q5: What methodology was used to gather the data for this comparison?

A5: The study used a data compilation methodology. The authors gathered information from publicly available sources, including industry association websites like caef.eu, national financial and legal registries in Slovakia (finstat.sk) and the Czech Republic (justice.cz), and the individual websites of the foundries themselves to determine which casting techniques and materials they used.

Q6: Does the paper indicate which country has a more modern or automated foundry industry?

A6: The paper provides one data point on automation. Figure 8 shows the percentage of foundries using automatic moulding lines. The figures are 38% for Slovakia and 29% for the Czech Republic. While this suggests a slightly higher adoption of automatic moulding lines in the surveyed Slovak foundries, the paper does not make a broader conclusion about which industry is more modern overall.

Q7: What is the paper's outlook for the foundry industry in this region?

A7: The outlook presented in the paper is cautious. The authors state that the worldwide COVID-19 restrictions and increasing unemployment in 2020 will have a negative impact on the automotive industry and its entire supply chain. They predict these negative impacts will persist into 2021 and that achieving pre-crisis production levels will require several years.

Conclusion: Paving the Way for Higher Quality and Productivity

This research provides a clear and data-driven Foundry Industry Comparison between Slovakia and the Czech Republic, revealing two distinct but interconnected markets. For professionals in the HPDC and broader casting sectors, the key takeaway is the importance of understanding regional specializations. While the Czech Republic offers scale and a deep base in ferrous metals, Slovakia presents a higher concentration of HPDC specialists, crucial for the automotive industry's push towards lightweighting. This strategic intelligence is vital for optimizing supply chains, identifying new opportunities, and navigating the challenges of a market heavily influenced by automotive trends.

"At CASTMAN, we are committed to applying the latest industry research to help our customers achieve higher productivity and quality. If the challenges discussed in this paper align with your operational goals, contact our engineering team to explore how these principles can be implemented in your components."

Copyright Information

This content is a summary and analysis based on the paper "COMPARISON OF FOUNDRY INDUSTRY IN SLOVAKIA AND CZECH REPUBLIC" by "Roland ŠUBA, Ingrida BAJČIČÁKOVÁ, Martin BAJČIČÁK, Štefan PODHORSKÝ, Antonín KŘÍŽ".

Source: DOI 10.2478/rput-2020-0017

This material is for informational purposes only. Unauthorized commercial use is prohibited.

Copyright © 2025 CASTMAN. All rights reserved.