Paper Title Navigating the Perfect Storm: A Deep Dive into the Automotive Industry's Impact on Aluminum Foundries

This technical summary is based on the academic paper "Circumstances of the Automotive Industry Impact on Aluminum Foundries" by R. Gallo, published in AFS Proceedings 2010 American Foundry Society (2010).

Keywords

- Primary Keyword: Aluminum Foundries

- Secondary Keywords: Automotive Industry, High Pressure Die Casting (HPDC), Competitive Environment, Casting Tonnage, Porter's Five Forces

Executive Summary

- The Challenge: U.S. aluminum foundries face a highly competitive, low-margin environment defined by a heavy dependence on the volatile automotive market and intense global competition.

- The Method: The paper analyzes decades of industry production data and applies Porter's Five Forces model to systematically diagnose the competitive pressures shaping the market.

- The Key Breakthrough: The analysis identifies fierce internal rivalry among foundries and the immense bargaining power of automotive buyers as the two primary forces squeezing foundry profitability and driving market consolidation.

- The Bottom Line: To survive and succeed in this challenging marketplace, aluminum foundries must rapidly adapt to customer demands, aggressively control costs, and strategically navigate strong global competition.

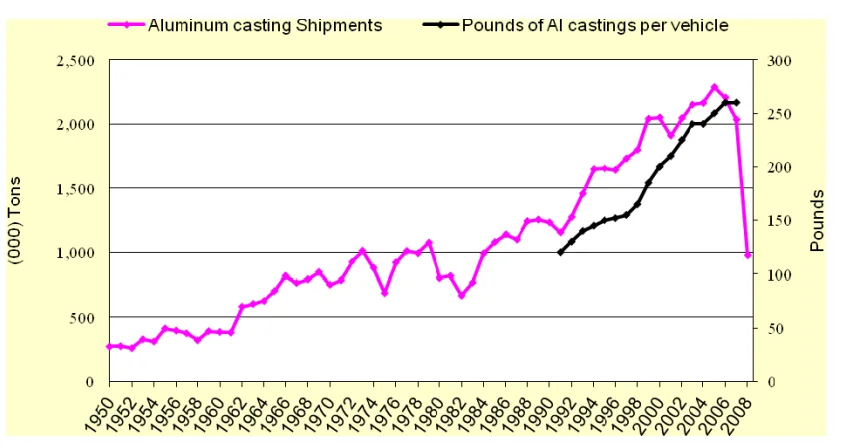

The Challenge: Why This Research Matters for HPDC Professionals

At the close of the 2000s, executives in the aluminum foundry industry faced a harsh new reality. The high production levels of the mid-2000s were a distant memory, replaced by a more prudent and realistic outlook following the collapse of the U.S. auto industry in 2008. This downturn was not a temporary recession but a manifestation of a long-term loss of market share to global competition. The U.S. foundry industry has been dramatically reshaped over the last several decades, with thousands of foundries closing or consolidating. While aluminum foundries experienced continuous growth from the 1950s to a peak in 2005, the subsequent slowdown highlighted an urgent need to understand the complex market forces at play. For any foundry to succeed, it is no longer enough to manage internal factors like labor and technology; they must also master the demands of a fiercely competitive global environment.

The Approach: Unpacking the Methodology

This paper provides a comprehensive market analysis rather than a traditional laboratory study. The author establishes 2005 as a key reference year, as it marked the highest tonnage ever produced by U.S. aluminum foundries and was the last year the U.S. was the world's largest automotive vehicle producer. The core of the analysis is built on Porter's Five Forces model of competition, a powerful framework used to diagnose the industry's competitive environment. The author examines the collective interaction of five key forces: rivalry among competing foundries, the bargaining power of buyers, the threat of new entrants, the bargaining power of suppliers, and the threat of substitute products. Data to support this analysis was compiled from decades of industry reports, including the "Census of World Casting Production" from Modern Casting and production statistics from the Organisation Internationale des Constructeurs d'Automobiles (OICA).

The Breakthrough: Key Findings & Data

The paper's analysis of market data reveals a clear picture of the industry's structure and the primary pressures affecting profitability.

Finding 1: The Dominance of Automotive and High-Pressure Die Casting (HPDC)

The automotive sector is, by a significant margin, the primary consumer of aluminum castings. As shown in Figure 9, "Motor vehicles and parts" accounted for 63.0% of the main end-user market in 2005 (excluding die casters). Furthermore, the method of production is dominated by a single process. Figure 7 illustrates that of the 2.29 million tons of aluminum castings produced in 2005, High-Pressure Die Casting (HPDC) accounted for the majority share at 59%. The remaining tonnage was divided between permanent mold/low pressure (26%) and sand/lost foam (15%). This heavy reliance on a single end-market and a primary production method concentrates both risk and competition.

Finding 2: Fierce Rivalry and Buyer Power Define the Competitive Landscape

The study uses the five forces model to quantify the competitive pressures. As summarized in Figure 12, the two most powerful forces create a challenging environment for Aluminum Foundries. "Competing rivalry among foundries" is rated as "Fierce" due to the commodity nature of many castings, a slow-growing market, and foreign competition. Simultaneously, the "Pressure from buyers bargaining power" is rated as "Strong." Large original equipment manufacturers (OEMs) in the automotive industry can leverage their large-volume purchases and knowledge of supplier costs to negotiate lower prices, directly impacting foundry margins. The collective impact of these forces fuels an intensely competitive, low-margin environment.

Practical Implications for R&D and Operations

- For Process Engineers: The paper's finding of "fierce" price competition means that continuous process optimization for cost reduction is not just a goal but a critical survival strategy. Every efficiency gained in melting, casting, and finishing directly contributes to competitiveness in a market where price is a primary decision factor.

- For Quality Control Teams: The research notes that in the 21st century, quality is not a feature that commands a higher price but is an expected baseline for doing business. This reinforces the critical role of QC teams in maintaining customer relationships and avoiding costly disruptions, as quality alone is no longer a significant negotiating factor for pricing.

- For Design Engineers: The findings highlight the ongoing pressure from substitute products, such as polymers for intake manifolds, and the potential for die casting facilities to convert permanent mold castings to the HPDC process. This underscores the need for design engineers to consider material properties, manufacturing processes, and cost implications early in the design phase to ensure aluminum castings remain the optimal choice.

Paper Details

Circumstances of the Automotive Industry Impact on Aluminum Foundries

1. Overview:

- Title: Circumstances of the Automotive Industry Impact on Aluminum Foundries

- Author: R. Gallo

- Year of publication: 2010

- Journal/academic society of publication: AFS Proceedings 2010 American Foundry Society, Schaumburg, IL USA

- Keywords: Aluminum Foundries, Automotive Industry, Competitive Environment, Casting, Five Forces Model

2. Abstract:

At the beginning of the 4th quarter of 2009, aluminum foundry executives still are showing signs of prudence. They are less positive and more realistic than they were on the early 2000. It will take several years for the aluminum foundry industry to fully recover to the high production levels of the mid 2000s. The collapse of the U.S. auto industry in 2008, the continued downsizing of U.S. foundries, and the development and start up of foundries abroad would not necessarily translate in positive impact for the U.S. foundries. While the global foundry industry has undergone significant changes in recent years, the U.S. foundry industry has been dramatically shaped and changed for the last 62 years. There have been thousands of foundries closing down, and recently, consolidating. Despite the fact that the U.S. foundry industry as a whole has been shrinking, aluminum foundries on the other hand have experienced continuous growth since the 1950s up to the mid 2000s. The total shipment of castings in 2005 was 14.2 tons. Shipments of aluminum castings in the U.S. have quintupled in the last five decades, with an average of 2.1 million tons per year in the first five years of the 2000s. Forecasting of the aluminum casting tonnage was reasonably predicted until 2007. For the last two years, market conditions and global competition have proven to be a challenge to predict with higher levels of confidence the future of aluminum casting tonnage shipments. Still the total casting tonnage shipments of 10.0 million tons reforecast for 2009 are expected to be 20% lower than 2008. Looking at the recent aluminum casting shipments trend, and the projected future of casting sales, it is evident, more than ever, that if the foundry industry wants to succeed, not only factors of competition such as labor, raw material, energy cost, and foundry technology are essential to be controlled. Like it or not, foundries must rapidly adapt to the demands of customers and strong global competition. The aluminum casting industry went through a solid growth period from 2002 to 2005. Incidentally, 2005 was the year in which U.S. aluminum foundries produced the highest tonnage recorded in history. In 2006, the industry started to show an indication of a slowdown. Along these lines, and for the purpose of writing this article, 2005 will be taken as a reference year to compare and to relate the present casting conditions and challenges ahead. This article will cover the impact of the auto industry on aluminum foundries in the U.S., and present the five forces model of competition to show how the interaction of them collectively determines the aluminum foundry competitive environment. Thus, the purpose of this article is to present some thoughts that might be appropriate for each of us to consider in this extremely challenging marketplace.

3. Introduction:

The global production of automotive vehicles expanded significantly from 1979 to 2008, yet the traditional markets of Japan, North America, and Western Europe continued to dominate. The U.S. automotive industry, while no longer the world's largest producer after 2005, remained the largest consumer of vehicles. By 2008, both Japan and China had surpassed the U.S. in vehicle production. This shift in global manufacturing, combined with the U.S.'s high consumption rate, created a highly competitive market for the foundries serving it.

4. Summary of the study:

Background of the research topic:

The paper examines the U.S. aluminum foundry industry in the context of the late 2000s global economic slowdown and the 2008 U.S. auto industry crisis. It frames the industry's situation not as a result of a short-term recession, but as a manifestation of a long-term loss of market share to global competition, exacerbated by the struggling economy.

Status of previous research:

The analysis is built upon historical data from established industry sources, primarily the annual "Census of World Casting Production" published by Modern Casting. The paper synthesizes decades of these reports to track trends in tonnage, market share, and the number of operating foundries, providing a longitudinal view of the industry's evolution.

Purpose of the study:

The purpose of the article is to cover the impact of the auto industry on aluminum foundries in the U.S. and to present the five forces model of competition to show how their interaction collectively determines the aluminum foundry competitive environment. The goal is to present thoughts for consideration in an extremely challenging marketplace.

Core study:

The core of the study involves a detailed analysis of the U.S. aluminum casting market, with a focus on the benchmark year of 2005. It quantifies the automotive sector's dominance as an end-user and breaks down the market share of different casting processes (HPDC, permanent mold, sand casting). The study then applies Porter's Five Forces model to assess the competitive pressures from rivals, buyers, suppliers, new entrants, and substitute products, ultimately identifying the main driving forces shaping the industry.

5. Research Methodology

Research Design:

The research is a descriptive and analytical study of a specific industry sector. It uses a historical, data-driven approach to establish market trends and a recognized strategic framework (Porter's Five Forces) to analyze the competitive structure of the industry. The year 2005 is used as a consistent benchmark for comparison.

Data Collection and Analysis Methods:

Data was collected from publicly available sources, including academic society proceedings, industry trade publications (Modern Casting), international automotive production statistics (OICA), and U.S. government reports (Department of Commerce, Department of Energy). The analysis involves synthesizing this quantitative data (e.g., production tonnage, market share percentages) within the qualitative framework of the five forces model to draw conclusions about the industry's competitive intensity.

Research Topics and Scope:

The scope is focused on the U.S. aluminum foundry industry and its relationship with the automotive sector from the 1950s through 2009. Key topics include historical production trends, the decline in the number of foundries, market segmentation by casting process and end-user, and a detailed assessment of the competitive environment.

6. Key Results:

Key Results:

- In 2005, the U.S. was the world's largest automotive producer, manufacturing 12.0 million vehicles, or 18% of the global market.

- The U.S. aluminum casting industry produced its highest tonnage in history in 2005, shipping 2.29 million tons.

- High-Pressure Die Casting (HPDC) accounted for 59% of the total aluminum tonnage produced in 2005.

- The automotive sector is the dominant end-user, consuming 63% of the aluminum casting tonnage shipped by foundries in 2005.

- The number of operating foundries in the U.S. declined by nearly 66% over the 54 years leading up to the study.

- The competitive environment is rated as "fierce" due to strong rivalry among foundries and strong bargaining power from automotive buyers.

- The threat of new competitors entering the U.S. market is considered low due to high capital investment, a slow-growth market, and strict environmental regulations.

- Energy suppliers have strong bargaining power due to the energy-intensive nature of the casting process and volatile energy prices.

Figure Name List:

- Fig. 1. 2005 vehicle production in major countries.

- Fig. 2. 2005 vehicle sales in major countries

- Fig. 3. Automotive influence in aluminum casting shipments.

- Fig. 4. Castings tonnage produced by metal type in 2005.

- Fig. 5. Aluminum casting shipments.

- Fig. 6. Average weight of aluminum castings per vehicle.

- Fig. 7. Aluminum casting market share between aluminum foundries and aluminum die casters in 2005.

- Fig. 8. Aluminum castings by end-user market in 2005, excluding die casters.

- Fig. 9. Aluminum castings main end-user market in 2005, excluding die casters.

- Fig. 10. Distribution of aluminum foundries by number of employees.

- Fig. 11. The five forces of competition

- Fig. 12. Individual impact of competitive forces

7. Conclusion:

The U.S. automotive industry meltdown in 2008 had a significant impact on the foundry business, but the industry's challenges are a manifestation of a long-term loss of market share to global competition. The number of U.S. foundries has declined significantly due to foreign competition and environmental compliance. Although small in number, the U.S. aluminum foundry industry is highly productive, with HPDC operations shipping more tonnage than other aluminum foundries. The automotive sector dominates the market, consuming about 63% of tonnage, making it a highly competitive, low-margin segment. To grow, U.S. foundries must look outside the U.S. for market share, as their domestic opportunities are affected by the number of imported vehicles sold.

8. References:

네, 해당 목록도 마크다운 리스트로 정리해 드리겠습니다.

- Staff Report, “40th Census of World Casting Production,” Modern Casting (December 2006)

- Kirgin, K., “Feeling the Domino Effect,” Modern Casting (March 2009)

- OICA (Organisation Internationale des Constructeurs d’Automobiles), “Production Statistics," http://oica.net/category/production-statistics/

- Automotive News Europe, 2006 Global Market Data Book, Crain Communication Inc, (June 2006).

- Wikipedia Encyclopedia, “Automotive Industry Crisis of 2008," http://en.wikipedia.org/wiki/Automotive_industry_crisis_of_2008.

- Staff Report, “1st Census of World Casting Production,” Modern Casting (December 1967).

- Staff Report, “42nd Census of World Casting Production,” Modern Casting (December 2008).

- Lefebvre, J., Maquaire, J. P., “Use of the Low-Pressure in the Mass-Production Foundry -The Renault Example," Society of Die Casting Engineers (October 1979).

- Cooney, S., Yacobucci, B., “U.S. Automotive Industry: Policy Overview and Recent History.” CRS Report for Congress, April 2005, http://www.ncseonline.org/nle/crsreports/05apr/rl.pdf (June 2009).

- Staff Report, “35th Census of World Casting Production,” Modern Casting (December 2001).

- Compiled Report, "2006 AFS Metalcasting Forecasting &Trends,” American Foundry Society, Des Plaines, IL (2006).

- Stratecasts, Inc., Volumes 1 and 2 (August 2005).

- Schifo J.F., Radia, J. T., “Theoretical/Best Practice Energy Use in Metal Casting Operations,” U.S. Department of Energy (April 2004).

- Das, S., Hadley, W., and Miller, J.W., “Aluminum R&D for Automotive Uses and the Department of Energy’s Role," Oak Ridge National Laboratory (March 2000).

- Twarog, T., "State of the Industry”, Die Casting Engineer (January 2007).

- Stratecasts, Inc., Volumes 1 and 2 (August 2006).

- U.S. Department of Commerce, 2002 Economic Census issued January 2005, “Aluminum Foundries (Except Die-Casting)."

- U.S. Department of Energy, “Aluminum Industry of the Future, Fiscal Year 2004 Annual Report,” obtained September 9, 2005, from http://www.eere.energy.gov/industry.

- U. S. International Trade Commission, “Foundry Products: Competitive Conditions in the U.S. Market, Investigation No. 332-460, May 2005, retrieved August 29, 2005, from http://www.nffs.org/html/ITC%Issues%20Its%20.

- Radia, T. J., Schifo, J.F., U. S. International Trade Commission (2005).

- U.S. Environmental Protection Agency, “Sustainable Industry: Metal Casting Industry Profile," (1998).

Expert Q&A: Your Top Questions Answered

Q1: Why was 2005 chosen as the primary reference year for this analysis?

A1: The paper selects 2005 as a critical benchmark for two main reasons. First, it was the year in which U.S. aluminum foundries produced the highest tonnage recorded in history. Second, 2005 was the last year that the U.S. automotive industry was the largest vehicle producer in the world. This makes it an ideal reference point to compare and relate the subsequent industry slowdown and the challenges that followed.

Q2: The paper rates the "Pressure from entry of new competitors" as low. What are the main barriers preventing new foundries from entering the U.S. market?

A2: According to the paper, there are several high entry barriers that make starting a new aluminum foundry in the U.S. unattractive. These include the significant capital investment required, a slow-growth (almost stagnant) market which limits opportunities for newcomers, a steep learning curve to compete effectively, and the high costs associated with complying with strict environmental regulations.

Q3: What are the two most significant competitive forces that create such a difficult market for aluminum foundries?

A3: The analysis concludes that the collective impact of the competitive forces is "fierce" because of two dominant factors. The first is the intense rivalry among existing foundries, which are competing for business in a mature market with a commodity product. The second is the strong bargaining power of automotive buyers (OEMs), who leverage their large-volume orders to negotiate favorable pricing, thereby squeezing foundry profit margins.

Q4: How has the geographic landscape of automotive production shifted, and what does this mean for U.S. foundries?

A4: The paper highlights a major shift, noting that while the U.S. was the top vehicle producer in 2005, it was surpassed by Japan in 2006 and by both Japan and China in 2008. This globalization of production means U.S. foundries can no longer rely solely on the domestic market. The paper explicitly states that "aluminum foundries must look outside the U.S. for increasing market share" to compensate for domestic market dynamics and the high volume of imported vehicles.

Q5: The paper mentions HPDC accounts for a majority (59%) of aluminum casting tonnage. What are the other major processes and their market shares?

A5: As detailed in Figure 7, the 2.29 million tons of aluminum castings produced in 2005 were made using three main process categories. High-Pressure Die Casting (HPDC) was the leader with 59% of the tonnage. The other processes were Permanent Mold & Low Pressure (PM & LP), which accounted for 26%, and Sand & Lost Foam (S & LF), which made up the remaining 15%.

Conclusion: Paving the Way for Higher Quality and Productivity

This deep dive into the market forces shaping the U.S. aluminum foundry industry reveals a landscape defined by intense competition and powerful customers. The core challenge stems from a fierce rivalry for business in a mature market and the strong pricing leverage held by automotive OEMs. For Aluminum Foundries to thrive, they must move beyond simply producing quality parts; they must become strategic partners who can adapt rapidly, manage costs relentlessly, and compete on a global scale. The insights from this analysis are a critical reminder that success in today's market requires both technical excellence and a profound understanding of the competitive environment.

"At CASTMAN, we are committed to applying the latest industry research to help our customers achieve higher productivity and quality. If the challenges discussed in this paper align with your operational goals, contact our engineering team to explore how these principles can be implemented in your components."

Copyright Information

- This content is a summary and analysis based on the paper "Circumstances of the Automotive Industry Impact on Aluminum Foundries" by "R. Gallo".

- Source: AFS Proceedings 2010 American Foundry Society, Paper 10-004

This material is for informational purposes only. Unauthorized commercial use is prohibited.

Copyright © 2025 CASTMAN. All rights reserved.