Global Foundry Forecast 2025: Navigating E-Mobility, Lightweighting, and Geopolitical Shifts

This technical summary is based on the academic paper "Forecast 2025 for the global Foundry Industry" by Dr. Heinz-Jürgen Büchner, published in IKB Deutsche Industriebank (2019).

Keywords

- Primary Keyword: Foundry Industry Forecast 2025

- Secondary Keywords: Aluminum Casting Trends, Iron Casting Production, E-Mobility Impact on Foundries, Automotive Casting Forecast, Lightweighting in Automotive, Global Casting Market

Executive Summary

- The Challenge: The global foundry industry faces a complex future shaped by slowing economic growth, geopolitical instability, and the disruptive technological shift towards e-mobility and lightweight construction.

- The Method: The forecast is built on a comprehensive analysis of macroeconomic data, customer industry production outlooks (automotive, mechanical engineering, construction), and historical casting production data from leading industry sources.

- The Key Breakthrough: While iron cast production is set to stabilize or slightly decline in established markets due to the rise of EVs, aluminum cast production is forecast to strengthen significantly across all major regions, driven by lightweighting and new vehicle technologies.

- The Bottom Line: Foundries must strategically adapt to a bifurcated market: managing declining demand for traditional iron powertrain components while capitalizing on the high-growth opportunities in aluminum casting for EV and lightweight applications.

The Challenge: Why This Research Matters for HPDC Professionals

In an era of unprecedented change, strategic planning is more critical than ever. The global foundry industry stands at a crossroads, impacted by volatile macroeconomic conditions, escalating trade conflicts, and the profound technological disruption of e-mobility. For engineers, R&D managers, and procurement specialists, understanding these interconnected forces is essential for making informed decisions. This forecast addresses the core questions facing the industry: How will the shift away from internal combustion engines affect demand for iron and aluminum castings? Which geographic regions will offer growth, and which will stagnate? What are the key strategic challenges, from investment requirements to supply chain digitalization, that will define the winners and losers by 2025?

The Approach: Unpacking the Forecast's Foundation

This forecast's credibility stems from its multi-faceted approach, synthesizing data from globally recognized economic and industrial sources to build a comprehensive market outlook.

Method 1: Macroeconomic Analysis: The forecast is grounded in an analysis of key economic indicators, including real GDP growth rates for the US, China, and the Euro Zone. It also incorporates the impact of geopolitical factors such as crude oil price fluctuations, trade wars, Brexit, and regional instability, providing a realistic context for industrial demand. (Sources: Bloomberg, IKB)

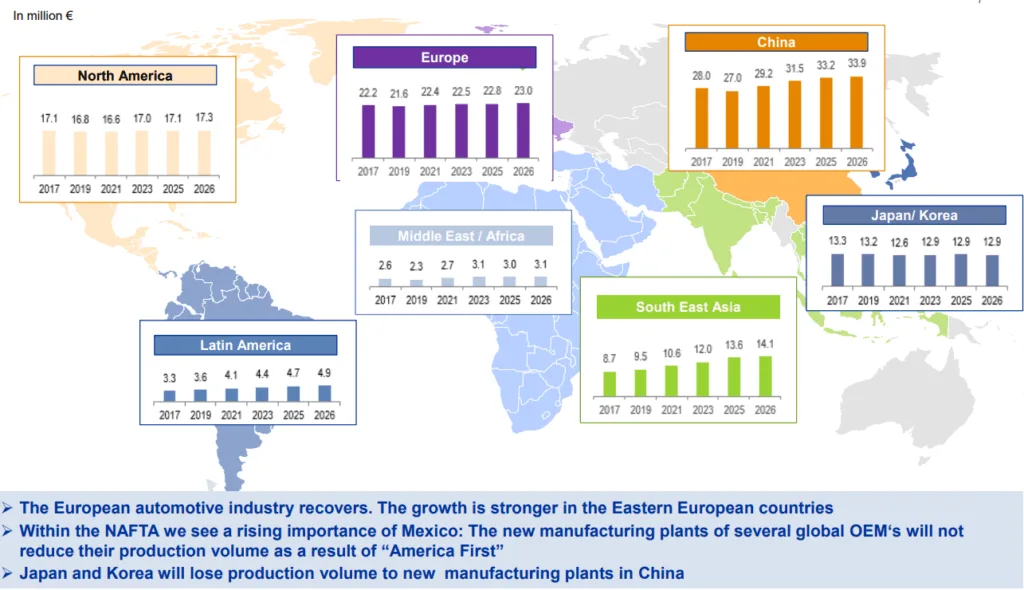

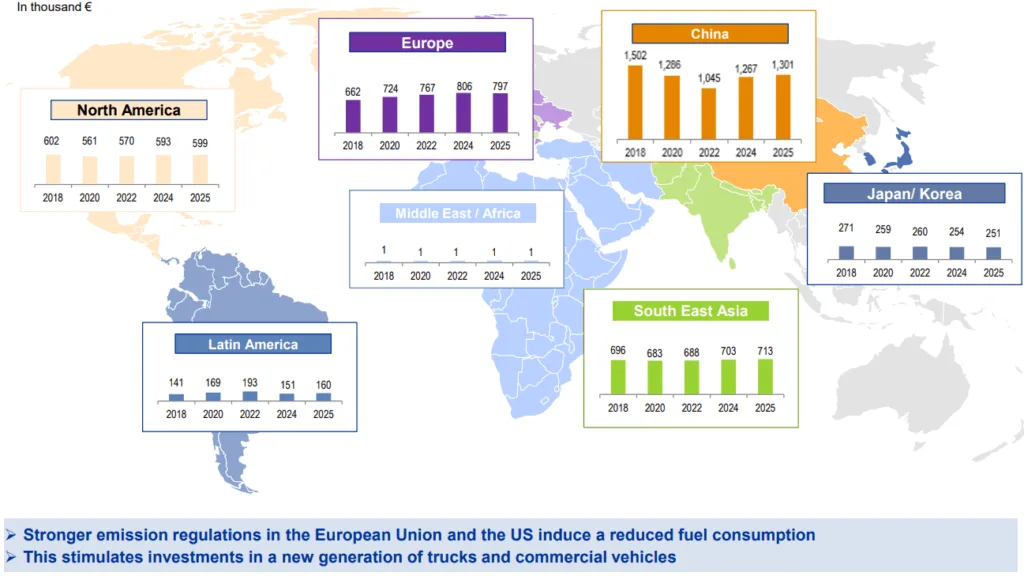

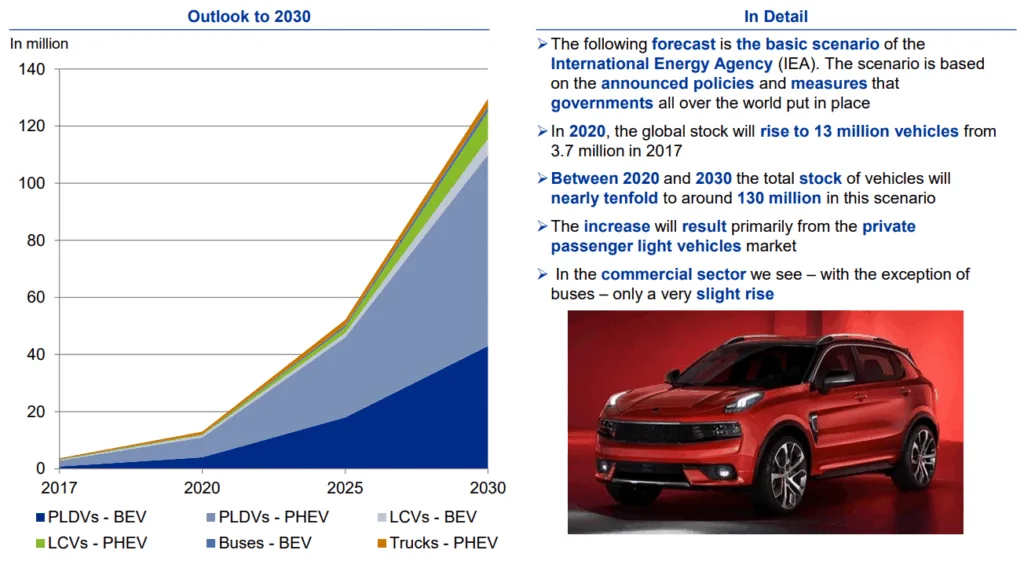

Method 2: Customer Industry Outlook: The analysis drills down into the primary markets for castings. It includes detailed production forecasts for light vehicles, medium & heavy vehicles, mechanical engineering, and the construction sector across all major global regions. A specific focus is placed on the projected growth of the global electric vehicle stock. (Sources: IHS, VDMA, ZVEI, IEA, Euroconstruct)

Method 3: Historical and Forecasted Casting Production: The report analyzes historical production trends for cast iron, aluminum, and copper from 2000 to 2017. This baseline is then used to project future output through 2025 for key regions (NAFTA, Europe, China, Other Asia), providing a granular view of market evolution by material type. (Sources: CAEF, World Census, IKB Research)

The Breakthrough: Key Findings & Data

The forecast reveals a clear divergence in the future of ferrous and non-ferrous casting, driven primarily by the automotive sector's transformation.

Finding 1: Iron Cast Production Stabilizes Globally, Dominated by Asia

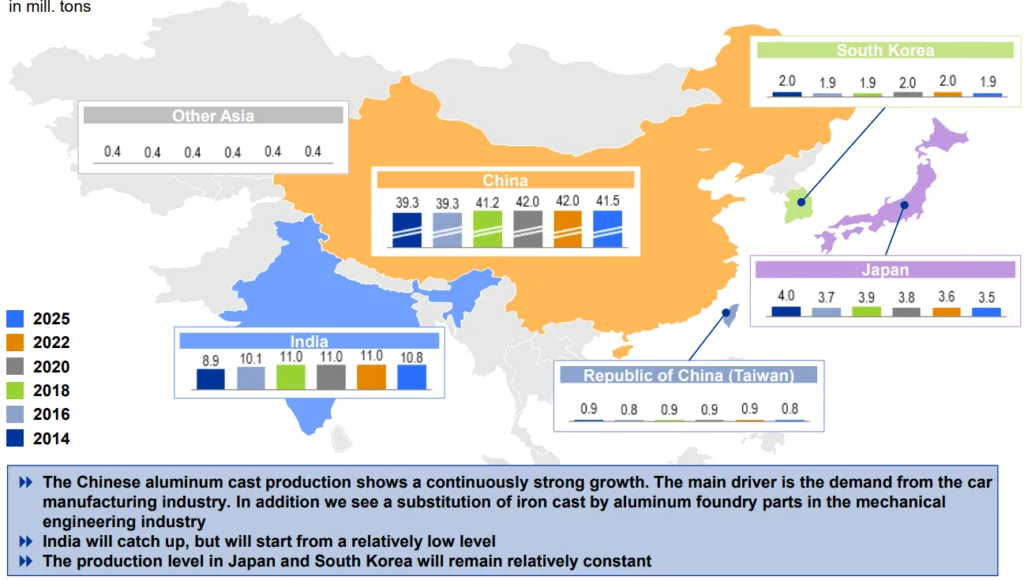

Global iron cast production is forecast to stabilize, with growth concentrated in emerging markets. As detailed on slide 15, China expanded its output from 9.9 million tons in 2000 to approximately 41 million tons in 2017, and it will continue to dominate the market. The forecast on slide 17 shows China's production leveling off around 41.5-42.0 million tons through 2025. While Western Europe and NAFTA see stable to slightly declining volumes, India is projected to show significant growth, catching up as a major production hub (Slide 26). The primary headwind is the decline in demand for traditional powertrain components due to electrification.

Finding 2: Aluminum Cast Production on a Strong Global Growth Path

The trend towards lightweighting and electric vehicles is a powerful catalyst for aluminum casting. Global production is forecast to strengthen significantly. As shown on slide 19, NAFTA's aluminum cast production is expected to grow from 2.5 million tons in 2014 to 3.3 million tons by 2025. Western Europe sees a similar rise from 2.5 to 3.2 million tons. This growth is fueled by investments from global OEMs and foundry groups to meet demand for EV components, battery housings, and structural parts, directly substituting heavier iron castings.

Practical Implications for R&D and Operations

- For Process Engineers: The report's emphasis on lightweighting (Slide 23) suggests a critical need to optimize processes for thin-walled, complex aluminum castings. The substitution of iron cast by aluminum cast will require process adaptation and investment in new technologies.

- For Quality Control Teams: The data on slide 24 highlights "increased complexity of metal alloy" as a key challenge. This implies that QC teams must develop more sophisticated inspection and testing protocols to validate the performance of new lightweight alloys used in critical structural and powertrain applications.

- For Design Engineers: The findings on slide 23, which link a higher usage of copper and increased battery weight to an intensified trend towards lightweight production, are a direct call to action. This suggests that early-stage design collaboration with foundries is crucial to optimize part geometry for castability and weight reduction using aluminum.

Paper Details

Forecast 2025 for the global Foundry Industry

1. Overview:

- Title: Forecast 2025 for the global Foundry Industry

- Author: Dr. Heinz-Jürgen Büchner

- Year of publication: 2019 (June)

- Journal/academic society of publication: IKB Deutsche Industriebank (Presented at GIFA 2019)

- Keywords: Foundry Industry, Forecast, Casting, Iron Cast, Aluminum Cast, E-Mobility, Automotive Industry, Macroeconomic Environment

2. Abstract:

This presentation provides a forecast for the global foundry industry through 2025. It begins by analyzing the macroeconomic environment, including GDP growth rates, crude oil market dynamics, and significant geopolitical risks. It then examines key customer industries, such as automotive, mechanical engineering, and construction, to project future demand. The core of the presentation is a detailed forecast of global casting production for iron, aluminum, and copper, broken down by major geographic regions. Finally, it outlines the future challenges and strategic consequences for the worldwide casting industry, with a particular focus on the impact of e-mobility, lightweighting, and industry consolidation.

3. Introduction:

The presentation was delivered at the GIFA 2019 international foundry trade fair in Düsseldorf, Germany. It aims to provide industry stakeholders with a comprehensive outlook on the market developments, technological shifts, and strategic challenges that will shape the foundry sector in the coming years. The analysis is presented by IKB Deutsche Industriebank, a specialist in financing for medium-sized enterprises in Germany and Europe.

4. Summary of the study:

Background of the research topic:

The global foundry industry is a critical supplier to major industrial sectors, including automotive, mechanical engineering, and construction. Its performance is closely tied to global economic health and technological trends within these customer industries. The rise of e-mobility, increasing pressure for lightweight construction, and a volatile geopolitical landscape create significant uncertainty and necessitate a forward-looking analysis.

Status of previous research:

The study builds upon established industry data collection and analysis from sources such as the European Foundry Association (CAEF), the World Census of Castings, and market intelligence firms like IHS. It synthesizes this historical data with macroeconomic forecasts and proprietary IKB research to create a cohesive projection for the industry's future.

Purpose of the study:

The purpose is to provide a data-driven forecast to help foundry operators, suppliers, and customers navigate the evolving market landscape. It aims to identify key growth regions and material segments, quantify the impact of major trends like electrification, and highlight the strategic imperatives for foundries to remain competitive through 2025.

Core study:

The core of the study involves forecasting the production volumes of iron, aluminum, and copper castings for the period up to 2025. This is done for major economic blocs including NAFTA, Western Europe, Eastern Europe, China, Other Asia, and the Rest of the World. The forecasts are contextualized by an analysis of the macroeconomic environment and the specific demand drivers from key customer sectors. The study concludes by discussing the strategic consequences, such as the negative impact of e-mobility on iron cast demand and the need for foundries to address challenges like globalization, investment, and margin pressure.

5. Research Methodology

Research Design:

The study employs a quantitative forecasting methodology based on the analysis of historical time-series data and econometric modeling. It correlates macroeconomic indicators and customer industry production forecasts with foundry output.

Data Collection and Analysis Methods:

Data was collected from multiple public and private sources, including Bloomberg for economic data, IHS for automotive forecasts, VDMA for mechanical engineering, ZVEI for electronics, CAEF and World Census for historical casting production. The analysis involves trend extrapolation and scenario-based projections based on stated policies and technological shifts (e.g., IEA scenarios for electric vehicles).

Research Topics and Scope:

The scope is global, covering all major casting production regions. The topics include:

- Macroeconomic Environment (GDP, Oil, Geopolitics)

- Customer Industry Analysis (Automotive, Engineering, Construction, Electronics)

- Global Foundry Production Forecasts by Material (Iron, Aluminum, Copper)

- Future Challenges and Consequences (E-mobility, Lightweighting, Consolidation)

6. Key Results:

Key Results:

- Global iron cast production is projected to stabilize, with China remaining the dominant producer and India showing high growth potential. A shift of 10 million light vehicles to battery-electric vehicles is estimated to result in a reduction of around 500,000 tons of iron cast.

- Global aluminum cast production is expected to strengthen across all major regions, driven by the trend towards electric vehicles and lightweight construction.

- The trend towards e-mobility negatively affects suppliers of traditional powertrain components but creates opportunities in aluminum casting.

- Strategic challenges for foundries include globalization, managing technological shifts (e-mobility), retaining qualified personnel, high investment requirements, margin pressure, and ongoing industry consolidation.

Figure Name List:

- US Real GDP; qoq; in%

- China Real GDP; yoy; in %

- Euro Zone Real GDP; qoq; in %

- Brent Blend; US-$/Barrel

- Active Oil Rigs USA

- Production of Light Vehicles

- Production of Medium & Heavy Vehicles

- Global Electrical Vehicle Stock with strong Growth

- Mechanical Engineering: Slight Recovery in Europe, Growth in Asia

- World Market for Electric Products and Electronics

- Construction Sector: Further Growth Prospects

- Urbanization and Development of Megacities

- Recovery of the European Construction Sector

- Forecast Global Construction Sector

- Cast Iron Production from 2000 to 2017

- Cast Aluminium Production from 2000 to 2017

- Global Production of Iron and Ductile Iron Cast stabilizes

- Iron Cast recovers in Eastern Europe

- Global Aluminum Cast Production will strengthen

- European Aluminum Cast Production shows stronger Growth

- Global Copper Casting Production with slight Increase

- Iron Cast in Asia: India with high Growth Potential

- Asian Aluminum Cast Production on further Growth Path

7. Conclusion:

The global foundry industry is entering a period of significant transformation. While overall growth in casting tonnage may be modest, there will be a substantial shift in material demand from iron to aluminum, primarily driven by the automotive industry's transition to electric and lightweight vehicles. China will continue to dominate the global market, but India will emerge as a key growth center. Foundries in developed economies face intense pressure to innovate, invest in new technologies, and manage rising energy and labor costs to remain competitive. The report concludes that the combination of increased investment requirements and technological changes will intensify industry consolidation.

8. References:

- Sources: Bloomberg

- Sources: 1) Bloomberg 2) Baker Hughes North America Rotary Rig Count

- Source: IHS March 2019

- Source: IHS January 2019

- Source: International Energy Agency; Picture credit: Lynk & Co 01

- Sources: VDMA, IKB estimates

- Sources: ZVEI, IKB forecast

- Sources: Euroconstruct, UNEP, CIC

- Sources: CAEF, Modern Census, IKB Research

- Sources: World Census, CAEF, IKB forecast; 1) Including Steel Cast

- Sources: World Census, CAEF, IKB forecast

Expert Q&A: Your Top Questions Answered

Q1: The forecast predicts a 500,000-ton reduction in iron cast from a 10-million-vehicle shift to EVs. What is the basis for this specific calculation?

A1: This calculation, outlined on slide 23, is based on a clear set of assumptions. It assumes an average engine block weight of approximately 50 kg. By forecasting a shift of 10 million light vehicles from internal combustion engines to battery-electric vehicles, the resulting reduction in demand for these specific iron cast components is calculated as 10,000,000 vehicles * 50 kg/vehicle, which equals 500,000,000 kg, or 500,000 metric tons.

Q2: How does the forecast account for the impact of geopolitical risks like the US-China trade war on regional production volumes?

A2: The forecast explicitly incorporates these risks as part of the macroeconomic environment analysis on slides 5 and 6. It notes that the conflict with China has negative impacts on major trading partners and that threats of tariffs on automotive imports influence investment decisions. While the specific tonnage impact isn't isolated per risk, these factors temper the growth forecasts, particularly for export-oriented regions, and contribute to the projected stabilization or slight decline in markets like NAFTA and Western Europe.

Q3: The report shows strong growth in aluminum casting. Where is this growth primarily coming from, and is it enough to offset the decline in iron casting?

A3: The growth is primarily driven by the automotive sector's need for lightweight components for both EVs (battery housings, motor housings, structural parts) and more efficient combustion vehicles. Slide 23 highlights the "substitution of iron cast by aluminum cast" as a key trend. While the tonnage of aluminum is lighter, the value and complexity of these components are often higher. The forecast does not state that the aluminum tonnage will fully replace the lost iron tonnage on a one-to-one basis, but it clearly identifies aluminum casting as the primary growth segment for the industry.

Q4: Why is India highlighted as having such high growth potential for iron cast, especially when demand is declining elsewhere?

A4: Slide 26 explains that India's potential stems from two main factors. First, the country has an enormous investment backlog in infrastructure compared to China, which drives demand for construction-related iron castings. Second, its domestic car production is improving, creating rising demand for automotive foundry products. This internal, domestic demand is expected to fuel growth, contrasting with the mature, export-driven markets that are more immediately affected by the EV transition.

Q5: The presentation mentions "industry consolidation" as a key challenge. What are the main drivers behind this trend?

A5: According to slide 24, the primary drivers for consolidation are globalization pressure and increased investment requirements. Foundries need to invest heavily to keep up with technological changes (like the shift to aluminum and complex alloys), meet demands for a global presence from automotive customers, and manage rising energy costs. These high capital demands, combined with margin pressure, make it difficult for smaller, family-owned businesses to compete, leading to an environment ripe for consolidation.

Conclusion: Paving the Way for Higher Quality and Productivity

The global foundry landscape is being reshaped by powerful economic and technological forces. The core challenge is the transition away from traditional iron-heavy combustion engines toward a future dominated by lightweight, aluminum-intensive electric vehicles. The Foundry Industry Forecast 2025 makes it clear that success will depend on strategic adaptation. While the demand for certain iron castings will wane, significant growth opportunities are emerging in aluminum casting across North America, Europe, and Asia. For R&D and operations teams, the focus must shift to mastering complex alloys, optimizing lightweight designs, and investing in technologies that deliver higher value and efficiency.

"At CASTMAN, we are committed to applying the latest industry research to help our customers achieve higher productivity and quality. If the challenges discussed in this paper align with your operational goals, contact our engineering team to explore how these principles can be implemented in your components."

Copyright Information

This content is a summary and analysis based on the paper "Forecast 2025 for the global Foundry Industry" by "Dr. Heinz-Jürgen Büchner".

Source: Presentation at GIFA, Düsseldorf, June 2019 by IKB Deutsche Industriebank.

This material is for informational purposes only. Unauthorized commercial use is prohibited.

Copyright © 2025 CASTMAN. All rights reserved.