Benchmarking Your Foundry: Key Insights from India's Largest Investment Casting Cluster

This technical summary is based on the academic paper "5 Cs of Investment Casting Foundries in Rajkot Cluster – An Industrial Survey" by A.V. Sata and N.R. Maheta, published in ARCHIVES of FOUNDRY ENGINEERING (2021).

![Fig.1. Journey of Investment Casting Process – Ancient to Contemporary [3]](https://castman.co.kr/wp-content/uploads/image-3517-1024x138.webp)

![Fig. 2. Overall sales of investment casting foundries in different countries (in million USD) [2]](https://castman.co.kr/wp-content/uploads/image-3518.webp)

Keywords

- Primary Keyword: Investment Casting Foundries

- Secondary Keywords: Rajkot Cluster, Casting Capacity, Casting Capability, Foundry Benchmarking, Casting Defects, Investment Casting Process

Executive Summary

- The Challenge: To gain a clear, data-driven understanding of the operational realities, capabilities, and challenges within a major global hub for investment casting.

- The Method: An in-person industrial survey of 42 investment casting foundries in India's Rajkot cluster, representing nearly 25% of the region's total, focusing on 5 Cs: Capacity, Capability, Competency, Concerns, and Challenges.

- The Key Breakthrough: The survey reveals an average production capacity utilization of only 71%, with an average rejection rate of 4%, primarily stemming from the shell-making stage, highlighting specific areas for process improvement.

- The Bottom Line: Foundries in the Rajkot cluster have significant opportunities to increase value by improving capacity utilization, reducing defects through better shell-making control, and adopting advanced technologies to enter high-value markets like aerospace and biomedical.

The Challenge: Why This Research Matters for Casting Professionals

For any foundry manager, engineer, or procurement specialist, understanding the true state of the industry is critical for benchmarking, strategic planning, and supplier evaluation. While global market data exists, granular, on-the-ground information about a specific manufacturing cluster is rare. This research addresses that gap by focusing on the Rajkot cluster in India, a globally significant region with nearly 175 investment casting foundries—almost 30% of all such foundries in the country. The study was designed to move beyond high-level statistics and uncover the specific operational parameters, quality issues, and technological adoption rates that define this major industry hub. This provides a unique, detailed snapshot that is invaluable for anyone involved in the investment casting supply chain.

The Approach: Unpacking the Methodology

To ensure robust and reliable data, the researchers conducted a comprehensive industrial survey with a structured, in-person approach.

Method 1: Targeted Survey Design

A specific questionnaire was designed to address the "5 Cs":

- Capacity: Production tonnage, utilization percentage, domestic vs. export sales.

- Capability: Range of metals, casting weight and thickness limits, customer sectors.

- Competency: Availability of in-house testing facilities (wax, ceramic, mechanical, NDT).

- Concerns: Adoption of quality standards (e.g., IATF 16949), and awareness of modern technologies like 3D modeling, simulation, and IoT.

- Challenges: Data on major casting defects, their frequency, and overall rejection rates.

Method 2: In-Person Data Collection

The survey was administered through direct, in-person meetings with top management and nominated personnel at 42 different foundries. This direct engagement ensures a high level of detail and accuracy, capturing nuances that remote surveys might miss. The sample size represents nearly 25% of the foundries in the Rajkot cluster, making the findings a fair reflection of the industry's status in the region.

The Breakthrough: Key Findings & Data

The survey yielded critical data points that provide a clear benchmark for investment casting operations.

Finding 1: Significant Gaps in Capacity Utilization and High Rejection Rates

The data reveals a major opportunity for operational improvement. The average installed capacity of the surveyed foundries was 855 metric tons per year, but the average utilization was only 71% (Figure 5). This indicates that nearly one-fourth of the production capacity lies unutilized. Furthermore, the average overall rejection rate was found to be 4%, with a maximum reported rate as high as 14% (Figure 9). The survey pinpointed the shell-making stage as the primary source of these rejections, accounting for 39% of the total.

Finding 2: Common Defects and Their Root Causes

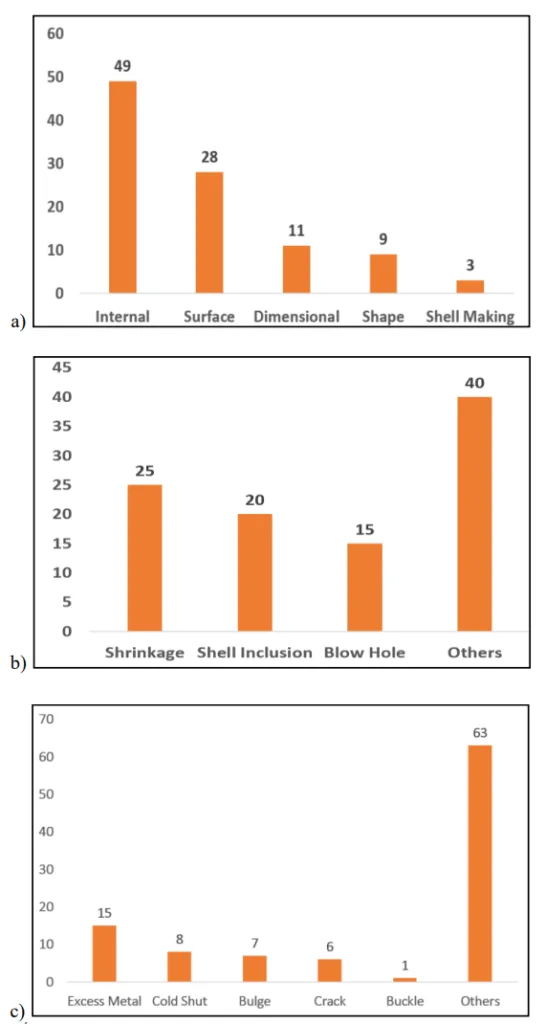

The study provides a detailed breakdown of the most pressing quality challenges. Internal defects were the most significant issue, accounting for 49% of all rejections. As shown in Figure 10(b), the most common internal defects were Shrinkage Porosity (25%) and Shell Inclusions (20%). Among external defects, Excess Metal (15%) was the most prevalent issue. This data gives process engineers a clear target for quality improvement initiatives, focusing on shell integrity and solidification control.

Practical Implications for R&D and Operations

- For Process Engineers: This study suggests that focusing on the shell-making process—including slurry control, dipping techniques, and shell baking parameters (average temp 750-1150 °C)—is the most effective way to reduce the overall 4% average rejection rate. The prevalence of shrinkage porosity (25% of internal defects) indicates a need for better simulation and gating design.

- For Quality Control Teams: The data in Figure 10 of the paper, which breaks down defect types, provides a powerful benchmarking tool. QC teams can compare their internal defect rates for shrinkage and shell inclusions against the cluster's average to identify areas of underperformance and justify investments in advanced inspection or process monitoring tools.

- For R&D and Strategy Managers: The survey highlights that most foundries in the cluster serve the general engineering and automotive sectors. The paper concludes there is a major opportunity to "move up the value chain" by developing capabilities for high-value alloys (Cobalt, Nickel, Titanium) for the aerospace, defense, and biomedical markets, where capacity utilization and profitability are typically higher.

Paper Details

5 Cs of Investment Casting Foundries in Rajkot Cluster – An Industrial Survey

1. Overview:

- Title: 5 Cs of Investment Casting Foundries in Rajkot Cluster – An Industrial Survey

- Author: A.V. Sata, N.R. Maheta

- Year of publication: 2021

- Journal/academic society of publication: ARCHIVES of FOUNDRY ENGINEERING, Volume 21, Issue 3/2021

- Keywords: Investment casting, Rajkot cluster, Capacity, Capability, Competency, Concerns, Challenges

2. Abstract:

Investment casting is very well-known manufacturing process for producing relatively thin and multifarious industrial components with high dimensional tolerances as well as admirable surface finish. Investment casting process is further comprised of sub-processes including pattern making, shell making, dewaxing, shell backing, melting and pouring. These sub-processes are usually followed by heat treatment, finishing as well as testing & measurement of castings. Investment castings are employed in many industrial sectors including aerospace, automobile, bio-medical, chemical, defense, etc. Overall market size of investment castings in world is nearly 12.15 billion USD and growing at a rate of 2.8% every year. India is among the top five investment casting producers in the world, and produces nearly 4% (considering value of castings) of global market. Rajkot (home town of authors) is one of largest clusters of investment casting in India, and has nearly 175 investment casting foundries that is almost 30% of investment casting foundries of India. An industrial survey of nearly 25% of investment casting foundries of Rajkot cluster has been conducted in the year 2019-20 in order to get better insight related to 5 Cs (Capacity; Capability; Competency; Concerns; Challenges) of investment casting foundries located in the cluster. Specific set of questionnaires was design for the survey to address 5 Cs of investment casting foundries of Rajkot cluster, and their inputs were recorded during the in-person survey. The industrial survey yielded in providing better insight related to 5 Cs of foundries in Rajkot cluster. It will also help investment casting producer to identify the capabilities and quality issues as well as leads to benchmarking respective foundry.

3. Introduction:

The paper provides an overview of the investment casting process, tracing its journey from ancient jewelry and idol making to its modern applications in industrial sectors like automobile, aerospace, biomedical, and defense. It highlights the expansion of the process to commercial alloys such as Aluminum, Cobalt, Copper, Nickel, Stainless Steel, and Titanium. The document establishes the context for the study by presenting the global market size for investment casting (approx. 12.15 billion USD) and India's position as one of the top five producers. It specifically identifies Rajkot as the largest investment casting cluster in India, with about 175 foundries, primarily serving the general engineering, pump, valve, and automotive sectors.

4. Summary of the study:

Background of the research topic:

The research is set against the backdrop of India's significant role in the global investment casting market. While India is a top producer, it primarily manufactures general engineering (80%) and automotive (14%) castings, with only a small fraction (6%) in high-value sectors. The Rajkot cluster, being the largest in India, serves as a representative microcosm of the nation's investment casting industry.

Status of previous research:

The paper cites global market data indicating North America, China, and the UK as the leading producers of investment castings. It contrasts their market distribution, noting that 90% of UK sales and 77% of North American sales are in high-value sectors (aerospace, defense), whereas India's production is dominated by lower-value general engineering components. This highlights a strategic gap and an opportunity for the Indian industry.

Purpose of the study:

The primary purpose was to conduct an industrial survey to gain detailed insights into the "5 Cs" (Capacity, Capability, Competency, Concerns, Challenges) of the investment casting foundries in the Rajkot cluster. The study aimed to create a benchmark that could help individual foundries identify their capabilities, address quality issues, and understand industry trends.

Core study:

The core of the study involved a survey of 42 investment casting foundries in Rajkot, representing about 25% of the cluster. A five-part questionnaire was used to collect data in-person from foundry management on topics including production capacity, export levels, casting size/thickness capabilities, in-house testing facilities, adoption of modern technology, and primary casting defects.

5. Research Methodology

Research Design:

The study employed a descriptive survey research design. A specific set of questionnaires was developed to systematically collect quantitative and qualitative data across the five defined areas (the 5 Cs).

Data Collection and Analysis Methods:

Data was collected through in-person interviews with top management at each of the 42 participating foundries during 2019-2020. This method was chosen to ensure high-quality, detailed responses. The collected data was then aggregated and analyzed to calculate minimum, maximum, and average values for key performance indicators such as installed capacity, utilization, rejection rates, and casting parameters.

Research Topics and Scope:

The research was scoped to the investment casting foundries located within the Rajkot cluster in India. The topics covered were:

- Capacity: Installed tonnage, utilization, export percentages.

- Capability: Metal types, casting weight range (0.005 kg to 350 kg), wall thickness (2 mm to 600 mm).

- Competency: Availability of in-house testing for wax, ceramics, mechanical properties, metallurgy, and NDT.

- Concerns: Use of quality standards and adoption of technologies like 3D modeling, simulation, and IoT.

- Challenges: Overall rejection rates and a breakdown of major internal and external defects.

6. Key Results:

Key Results:

- Capacity & Utilization: Average installed capacity is 855 MT/year, with an average utilization of 71%.

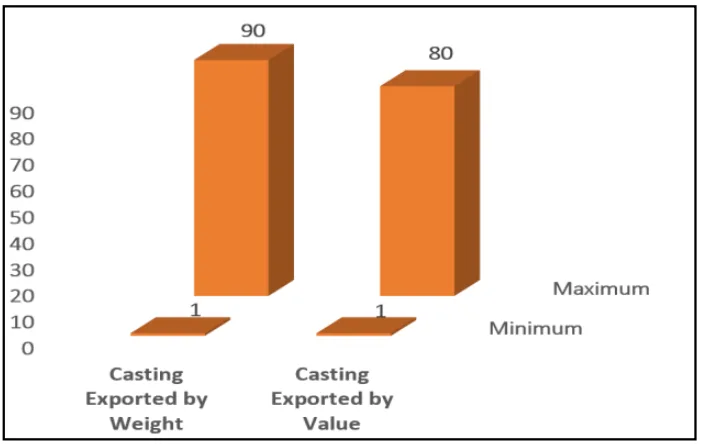

- Exports: Exports range widely from 1% to 90% of production by weight, with an average of 37%.

- Capability: Foundries can produce castings from 0.005 kg to 350 kg, with wall thicknesses from 2 mm to 600 mm.

- Competency: Only 20% of surveyed foundries have all in-house testing facilities. Mechanical (86%) and metallurgical (76%) testing are common, while ceramic (33%) and wax (50%) testing are less so.

- Technology Adoption: Over 40% use 3D modeling and casting simulation packages. About 20% are acquiring data and have awareness of IoT.

- Rejection Rates: The average overall rejection rate is 4%. The shell-making stage is the largest contributor to rejections.

- Major Defects: Internal defects (49%) are the most common, primarily shrinkage porosity (25%) and shell inclusions (20%).

Figure Name List:

- Fig.1. Journey of Investment Casting Process – Ancient to Contemporary [3]

- Fig. 2. Overall sales of investment casting foundries in different countries (in million USD) [2]

- Fig. 3. Distribution of overall sales for investment castings (in percentage of sales) [2]

- Fig. 4. Installed capacity (tonnage per year) of foundries in Rajkot cluster

- Fig. 5. Capacity utilization (tonnage per year) of foundries in Rajkot cluster

- Fig. 6. Casting exports by weight and value (in percentage of total sales)

- Fig. 7. Casting weight, wall thickness and lead time

- Fig. 8. Shell thickness and shell baking temperature

- Fig. 9. Overall Rejection (in percentage of total production)

- Fig. 10 (a), (b) and (c): Major Defects (in percentage of overall rejection), Internal Defects (in percentage of major defects), External defects (in percentage of major defects)

![Fig. 3. Distribution of overall sales for investment castings (in percentage of sales)[2]](https://castman.co.kr/wp-content/uploads/image-3519.webp)

7. Conclusion:

The survey reveals that nearly a quarter of the production capacity in the Rajkot cluster is unutilized. This presents an opportunity for foundries to explore new, high-value markets such as aerospace, defense, and biomedical, which require stringent quality standards but offer higher returns. To achieve this, Indian foundries need to move up the value chain by developing scientific and systematic approaches to quality assurance. The adoption of information technologies like process data analytics and the Industrial Internet of Things (IIoT) is identified as a key enabler for this transition. The study concludes that the created benchmark will help existing and emerging foundries identify key factors for improvement and understand future trends and challenges.

8. References:

- [1] Market Publishers (2020). Investment Casting Market Size, Share & Trends Analysis Report By Application (Aerospace & Defense, Energy Technology), By Region (North America, Europe, APAC, Central & South America, MEA), And Segment Forecasts, 2020 – 2027, 2020. Retrieved September, 2021, from https://pdf.marketpublishers.com/grand/investment-casting-market-size-share-trends-analysis-report-by-application-by-region-n-segment-forecasts-2020-2027.pdf

- [2] Investment Casting Institute (2021). INCAST International Magazine of the Investment Casting Institute and the European Investment Casters Federation, 2021, XXXIV. Retrieved September, 2021, from https://www.investmentcasting.org/current-issue--public.html

- [3] Online Learning Resources in Casting Design and Simulation. Retrieved September, 2021, from www.efoundry.iitb.ac.in

Expert Q&A: Your Top Questions Answered

Q1: Why was the Rajkot cluster chosen as the focus for this extensive survey?

A1: The Rajkot cluster was selected because it is the largest and one of the most significant hubs for investment casting in India. It is home to nearly 175 foundries, which constitutes almost 30% of the total investment casting foundries in the country. This high concentration makes it an ideal representative sample for understanding the broader trends, challenges, and capabilities of the Indian investment casting industry.

Q2: What was identified as the single biggest source of casting rejections in the surveyed foundries?

A2: The survey clearly identified the shell-making stage of the investment casting process as the largest contributor to overall rejections. While the average rejection rate was 4%, the shell-making process was responsible for 39% of those rejections. This suggests that improvements in slurry preparation, dipping techniques, shell drying, and baking protocols offer the most significant opportunity for quality improvement and cost reduction.

Q3: What are the most common and costly defects that foundries in this cluster are struggling with?

A3: The study found that internal defects are the most prevalent issue, accounting for 49% of all rejections. Within this category, shrinkage porosity was the most common defect, making up 25% of internal issues, followed closely by shell inclusions at 20%. These defects are particularly costly as they are often discovered late in the process, after significant value has already been added to the casting.

Q4: How advanced is the adoption of modern manufacturing technologies like simulation and IoT in this cluster?

A4: The survey indicates a mixed level of technology adoption. A positive finding is that over 40% of the foundries are using 3D modeling and casting simulation software, which is crucial for optimizing gating and reducing defects like shrinkage. However, adoption of more advanced Industry 4.0 technologies is still nascent, with only about 20% of foundries actively acquiring process data or having an awareness of the Internet of Things (IoT).

Q5: What is the primary strategic recommendation for the foundries based on the survey's findings?

A5: The key strategic recommendation is for the foundries to "move up the value chain." With an average capacity utilization of only 71% and a heavy focus on lower-value automotive and general engineering parts, there is a clear opportunity to enter more demanding and profitable sectors. This involves developing the capability to produce castings from high-value alloys like Cobalt, Nickel, and Titanium for the aerospace, biomedical, and defense industries, supported by robust quality systems and advanced manufacturing technology.

Conclusion: Paving the Way for Higher Quality and Productivity

This comprehensive survey of Investment Casting Foundries in the Rajkot cluster provides an invaluable, data-driven roadmap for improvement. It pinpoints the core challenge: a significant portion of unused capacity coupled with a 4% average rejection rate driven by shell-making issues and internal defects like shrinkage. The key breakthrough is the clear quantification of these issues, offering a benchmark for any foundry looking to enhance its operations. By focusing on process control in the shell room and leveraging simulation tools, foundries can directly attack their primary sources of loss and unlock greater productivity.

At CASTMAN, we are committed to applying the latest industry research to help our customers achieve higher productivity and quality. If the challenges discussed in this paper align with your operational goals, contact our engineering team to explore how these principles can be implemented in your components.

Copyright Information

This content is a summary and analysis based on the paper "5 Cs of Investment Casting Foundries in Rajkot Cluster – An Industrial Survey" by "A.V. Sata, N.R. Maheta".

Source: https://doi.org/10.24425/afe.2021.138672

This material is for informational purposes only. Unauthorized commercial use is prohibited.

Copyright © 2025 CASTMAN. All rights reserved.